Chapter 1 — Medicare Basics for Veterans

Everything you need to know to get started

1. Medicare at a Glance—What It Really Means for Veterans

Let’s start with the basics, but from a veteran’s perspective. You’ve navigated complex military systems throughout your career. Medicare should be no different once you understand how it works specifically for veterans.

Medicare is the federal health insurance program for Americans age 65 and older, plus some younger people with specific disabilities. But most generic Medicare guides won’t tell you that for veterans, Medicare isn’t just another insurance option. It’s often the keystone that holds your entire healthcare strategy together.

When you enroll in Medicare, it generally becomes the primary payer for medical services you receive outside the VA system. This means Medicare pays first, and other coverage like TRICARE for Life kicks in afterward (Source: TRICARE.mil, https://tricare.mil/Plans/HealthPlans/TFL). If you only have VA health benefits and no Medicare coverage, you cannot receive care outside the VA system unless the VA pre-authorizes it through their Community Care program, and they can deny those requests.

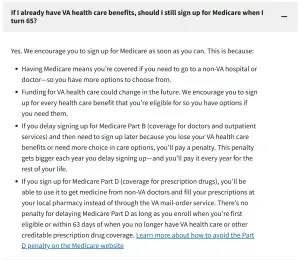

The VA itself encourages you to sign up for Medicare as backup coverage. In fact, the VA explicitly states on their website:

As you can see, the VA explicitly states they encourage veterans to sign up for Medicare because “Funding for VA health care could change in the future” and having Medicare means “you’re covered if you need to go to a non-VA hospital or doctor—so you have more options to choose from” (Source: VA.gov, https://www.va.gov/health-care/about-va-health-benefits/va-health-care-and-other-insurance/).

If you’re a military retiree, Medicare Parts A and B aren’t optional. They’re mandatory for keeping your TRICARE for Life benefits.

Think of it this way: Medicare is like the foundation of a house. Your VA benefits, TRICARE for Life, and other military health benefits are the rooms built on top of that foundation. Without a solid Medicare foundation, the whole structure becomes unstable.

Now, if you’re like my dad and use the VA for 95% of your health services, you might think of the VA as your primary foundation. But Medicare is still that critical backup structure, ready when the VA falls short. On more than one occasion, the VA has denied my father coverage. He didn’t panic because he had Medicare as his backup plan.

This layered approach isn’t just smart. It’s required. Why does this matter so much? Because life happens. Sometimes the closest VA facility is hours away. Maybe you need to see a specialist who’s not available through the VA, and the VA denies your Community Care referral.

Veterans must meet strict eligibility requirements for Community Care, including specific drive time and wait time standards, and the VA can deny requests that don’t meet their criteria. If your request is denied, you can appeal through the VA’s Clinical Appeals process, but that takes time you might not have when you need medical care (Source: VA.gov, https://www.va.gov/resources/eligibility-for-community-care-outside-va/). With Medicare as your backup, you have immediate access to civilian specialists without waiting for VA approval or appeals.

Perhaps you’re traveling and a medical emergency strikes. While the VA encourages veterans to seek immediate care without delay, they can only cover the cost of your emergency care if you meet specific requirements: you must be enrolled in VA healthcare, a VA facility wasn’t “feasibly available,” you must notify the VA within 72 hours of when your emergency care starts, and you must meet other situation-specific requirements (Source: VA.gov, https://www.va.gov/resources/getting-emergency-care-at-non-va-facilities/). Miss any of these criteria, and you could be stuck with the entire emergency room bill.

Just like you wouldn’t deploy with only one piece of critical equipment, you shouldn’t navigate retirement healthcare with only one coverage option. You’ve earned VA benefits through your military service AND you’ve paid into Medicare through FICA taxes your entire working life. Why would you rely on just one when you’ve rightfully earned access to both? Smart veterans layer their benefits strategically, creating multiple lines of defense for their healthcare needs.

2. The Four Parts: Decoded for Veterans

Medicare has different parts, and yes, it can seem complicated at first. After nearly two decades in the Medicare industry and helping thousands of veterans navigate these decisions, I can tell you that once you understand how each part works with your existing military benefits, it starts to make sense. Let me break it down in plain English:

Part A: Hospital Insurance

What it covers: Hospital stays, skilled nursing facilities, some home health care, hospice care

2025 cost: $0 for most veterans (you already paid through payroll taxes during your career)

Why veterans need it:

- Keeps TRICARE for Life active for military retirees

- Covers hospital stays anywhere Medicare is accepted

- Required foundation for all other Medicare benefits

Part B: Medical Insurance

What it covers: Doctor visits, outpatient services, preventive care, durable medical equipment, emergency room visits, diagnostic tests, and most medically necessary services outside of hospital stays (Source: CMS.gov, https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles)

2025 cost: $185/month standard premium (higher if you have high income due to IRMAA surcharges, which affect about 8% of Medicare beneficiaries) (Source: Veterans Advantage Financial, https://veteransadvantagefinancial.vet/irmaa/)

Why veterans need it:

- Required for TRICARE for Life: we see veterans lose their TRICARE for Life benefits when they don’t maintain Part B enrollment (Source: TRICARE.mil, https://tricare.mil/Plans/Eligibility/MedicareEligible)

- Required for any Medicare Advantage (Part C)

- Backbone of outpatient care nationwide

- Emergency room coverage anywhere in the US, even at facilities that don’t accept Medicare

- Enables access to options that keep Part B premiums as low as possible

Part C: Medicare Advantage

What it covers: Must at least provide every benefit that Part A and B cover, often with additional benefits that VA, Medicare, and TRICARE for Life don’t provide. Medicare states that “Medicare Advantage Plans must cover all of the services that Original Medicare covers” (Source: Medicare.gov, https://www.medicare.gov/basics/get-started-with-medicare/using-medicare/how-to-get-medicare-services)

Average $17/month for Medicare options from private companies, with 75% having no monthly premium. Keep reading to see why they have no monthly premium.

Why veterans need it:

- Allows continued use of VA and TRICARE benefits

- Many options help veterans avoid overpaying for Part B, with nearly one-third (32%) of Medicare options from private companies offering ways to minimize Part B costs in 2025 (Source: KFF.org, https://www.kff.org/medicare/issue-brief/medicare-advantage-2025-spotlight-a-first-look-at-plan-premiums-and-benefits/)

- Additional benefits that VA, Medicare, and TRICARE for Life don’t provide

- Can enhance military benefits, something my team and I specialize in helping veterans achieve

- Emergency room coverage anywhere in the US at any facility. Medicare Advantage plans must cover emergency and urgent care nationwide as in-network services, even if the facility isn’t in the plan’s network. Some Medicare Advantage plans may also include worldwide emergency coverage (Source: AARP, https://www.aarp.org/health/medicare-insurance/info-2024/medicare-coverage-on-vacation.html).

Part D: Prescription Drug Coverage

What it covers: Prescription medications (if not included in Part C)

2025 cost: Average $35-55/month for standalone plans

Why veterans should carefully evaluate Part D:

- VA prescription coverage is “creditable,” meaning there’s no penalty for delaying Medicare Part D as long as you enroll when first eligible or within 63 days of when you no longer have VA health care or other creditable prescription drug coverage (Source: KFF.org, https://www.kff.org/faqs/medicare-open-enrollment-faqs/i-have-drug-coverage-from-the-va-do-i-need-to-sign-up-for-a-part-d-plan/)

- TRICARE for Life includes prescription benefits

- Many Medicare options from private companies include drug coverage at no additional premium

Most veterans already have creditable prescription drug coverage through VA or TRICARE for Life, which protects them from Part D penalties. However, you should evaluate whether Part D might provide better coverage, lower costs, or access to medications not covered by your military benefits. Remember, having multiple prescription options gives you flexibility when the VA formulary doesn’t include a medication you need or when filling prescriptions while traveling.

3. Where the Money Comes From: You’ve Already Paid Your Dues

Something that might surprise you: Remember those old pay stubs from your military service and civilian career? There was a line item called “FICA”, the Federal Insurance Contributions Act tax that funds Social Security and Medicare. During my extensive time in the industry, I’ve seen thousands of veterans who don’t realize they’ve already paid for these benefits.

Think about it this way: if you earned around $50,000 a year over a 40-year career, you and your employers contributed about $58,000 toward Medicare through those FICA taxes on your pay stub at the current rate of 2.9% (Source: IRS.gov, https://www.irs.gov/taxtopics/tc751). If you averaged more than $50,000 per year, then a higher amount has been paid into Medicare by you and your employers. So when we talk about Medicare benefits, you’re not getting something “free.” You’re collecting on an investment you’ve been making your entire working life.

Many veterans we work with make a costly mistake. They skip Medicare Part B with the thought, “I have VA benefits, and that’s enough.” What they’re really saying is they don’t want to pay the Part B premium, and I don’t blame them for that concern.

This changes how you should think about Medicare costs: there are now Medicare options from private companies with premiums as low as $0 that help keep your Part B costs as low as possible.

Not enrolling in Part B is like walking away from decades of your own contributions to Medicare. You’ve already paid into the system your entire working life. Why would you walk away from benefits you’ve already paid for?

The bigger picture changes how you should think about Medicare costs. Those Medicare options from private companies with premiums as low as $0 aren’t really free. They’re funded partly by the taxes you already paid over decades of work. And when an option helps you avoid overpaying for Part B, you’re keeping more of what’s rightfully yours based on decades of FICA contributions.

My dad, Wallace Duncan, an 82-year-old Vietnam-era veteran, understands this perfectly. Through his Medicare option from a private company, he obtains the lowest possible Part B premium while maximizing additional benefits. This isn’t charity from an insurance company. It’s making the most of the investment he’s made through decades of payroll taxes. We help veterans access similar strategies to avoid overpaying for their Part B coverage.

4. Three Critical Reasons Veterans Cannot Ignore Medicare

Throughout my Medicare career, I’ve discovered unique challenges veterans face that most advisors never understand. I’ve seen what happens when veterans ignore Medicare thinking their military benefits are enough. Let me share the three most critical reasons my team and I tell every veteran they absolutely cannot afford to ignore Medicare.

Reason #1: VA Funding and Eligibility Can Change

The VA budget is set by Congress every year, and recent events prove how unpredictable this can be. In 2024, VA faced a $6.6 billion budget shortfall that required emergency congressional action to prevent service cuts (Source: Federal News Network, https://federalnewsnetwork.com/budget/2024/11/va-updates-fy-2025-health-care-budget-shortfall-to-6-6b-nearly-half-its-previous-estimate/).

We have worked with veterans who suddenly faced reduced VA services due to budget constraints they had no control over. Funding levels, eligibility criteria, and covered services can shift based on political decisions that have nothing to do with your needs. Your VA care might be affected by factors completely outside your control.

Medicare, however, is a federal entitlement. I hate the word entitlement because it implies something given rather than earned, when you’ve actually paid into Medicare your entire working life through FICA taxes. You’ve earned and paid for these benefits your entire working life. Once you’re enrolled, your coverage is guaranteed by law. It’s security you control, not politicians.

Reason #2: Emergency Freedom Nationwide

In a medical emergency, any hospital must treat you, even if it’s not a VA facility. But the catch is that the VA might not cover the bills if they determine it wasn’t an approved emergency or if you could have reasonably reached a VA facility.

Original Medicare and Medicare Advantage (Part C) provide universal emergency coverage at any hospital in the United States. I’ve worked with veterans who were vacationing in Florida when they had to go to the emergency room, 200 miles from the nearest VA facility. Their Medicare coverage meant immediate treatment without worrying about VA approval or massive bills. That’s the kind of protection every veteran needs, especially if you travel or live far from VA care.

Reason #3: TRICARE for Life Depends on It

If you’re a military retiree with TRICARE for Life, listen carefully: TRICARE for Life requires you to have both Medicare Part A and Part B. Skip Part B, and you lose TRICARE for Life entirely. This isn’t optional. Federal law (10 U.S.C. § 1075) specifically requires both Medicare Parts A and B to maintain TRICARE for Life eligibility (Source: TRICARE.mil, https://tricare.mil/Plans/Eligibility/MedicareEligible).

I’ve worked with military retirees who lost their TRICARE for Life benefits because they tried to skip Part B to save money. Once you lose TFL, getting it back requires enrolling in Medicare and potentially facing late enrollment penalties for the rest of your life.

Enrolling in Medicare on time ensures you keep this valuable benefit that acts as outstanding secondary coverage, eliminating virtually all out-of-pocket costs for covered medical services. When we work with career military veterans who have TRICARE for Life, we call it the ‘golden ticket’ of medical coverage. But that golden ticket only works if you maintain at least Medicare Parts A and B. Skip either one, and you lose this incredible benefit that you’ve earned through 20+ years of service.

Understanding these critical reasons is important, but it’s equally important to understand why generic Medicare advice consistently fails veterans.

5. Where Generic Medicare Advice Falls Short for Veterans

My team and I have cleaned up countless messes created by generic Medicare advisors who treat every 65-year-old the same way. The standard advice they give veterans is the exact same advice they give everyone else:

- “Just get a Medicare Supplement plan to cover the gaps”

- “Medicare Advantage plans limit your doctor choices”

- “You should always enroll in Part D to avoid penalties”

- “Original Medicare is always better than Medicare Advantage”

For civilian retirees, this one-size-fits-all approach might work. But veterans aren’t civilian retirees. Veterans have earned unique benefits through their service, and these benefits fundamentally change what makes sense for Medicare coverage.

The Veterans-Specific Questions Generic Advisors Never Ask

When we work with veterans, we start with questions that generic advisors never think to ask:

- Do you have TRICARE for Life?

- What’s your VA priority group?

- Do you use VA Community Care?

- How far do you live from VA facilities?

- What percentage of your care comes from the VA versus civilian providers?

These critical factors determine your optimal Medicare strategy. Generic advisors who don’t understand military benefits consistently provide advice that costs veterans thousands while missing valuable opportunities they’ve earned through their service.

Real-World Example: The Cookie-Cutter Failure

A career Air Force veteran contacted us after working with a generic Medicare advisor who recommended Original Medicare plus a $189 monthly Medigap Plan G because “it’s the gold standard.” The advisor never asked about military benefits or considered veteran-specific alternatives.

The generic advisor missed several critical points:

- The veteran had TRICARE for Life, making Medigap completely unnecessary

- A Medicare option from a private company in his area helped keep his Part B premium as low as possible

- The same option included additional benefits that VA, Medicare, and TFL don’t provide

- He could have been paying far less monthly while gaining additional benefits

The cost of generic advice: $3,948 annually in missed opportunities.

The Independence Advantage

We are completely independent. We don’t work for any insurance company or receive bonuses for recommending specific plans. When generic advisors tied to specific companies tell you “this is the best plan available,” they’re really saying “this is the best plan my company offers.”

We can evaluate every plan available in your area to find the one that actually maximizes your veteran benefits. This independence means we can recommend any solution that’s right for you, whether that’s Original Medicare, Medigap, or Medicare Advantage, without being restricted to specific companies or plan types.

What Makes Veteran-Specific Expertise Different

As specialists who work exclusively with veterans, we understand how Medicare works alongside your existing military benefits to create comprehensive coverage. We analyze how Medicare works alongside VA priority groups, TRICARE for Life requirements, and service-connected disability considerations.

Our expertise means recognizing that veterans with TRICARE for Life already have coverage that functions better than any Medicare Supplement plan, eliminating virtually all out-of-pocket costs. We understand that veterans often prefer specific provider networks through established VA relationships or TRICARE providers, making Medicare Advantage PPO plans particularly valuable for maintaining continuity of care while adding flexibility.

We evaluate prescription drug options knowing that TRICARE for Life includes robust pharmacy benefits through Express Scripts, while also understanding when Medicare Part D might provide access to medications not on the VA formulary or offer more convenient pharmacy options during travel. This complete understanding allows us to develop strategies that maximize every benefit you’ve earned through military service.

Now that you understand the basics, let me share the costly mistakes I see veterans make when they get generic Medicare advice instead of veteran-specific guidance.

6. Common Mistakes Veterans Make (And How Specialists Help You Avoid Them)

Working exclusively with veterans has shown me the same costly mistakes happen over and over when veterans rely on generic Medicare advice. Here are the four biggest missteps that cost veterans thousands:

Mistake #1: Waiting Past 65 to Enroll in Part B

Many veterans think, ‘The VA covers me, I’ll sign up later.’ This is one of the most expensive mistakes you can make. For every 12-month period you delay Part B after your Initial Enrollment Period, you face a lifelong 10% penalty on your Part B premium.

Wait just two years and you’ll pay an extra $37 monthly ($444 annually) based on today’s premium, but the kicker is that as Part B premiums increase every year, your penalty grows too because it’s a percentage of the current premium, not a fixed dollar amount. Over 20 years, that 20% penalty could easily cost you $10,000 or more (Source: Medicare.gov, https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties).

On a regular basis we have veterans that call us at age 70, 75 wanting to put their Part B in place, because the VA health system isn’t meeting all their needs. As my dad Wallace says, “Chris, the VA health system is great, but it ain’t perfect.” When veterans realize the VA can’t meet all their needs and try to add Part B, they discover they face both waiting periods and lifetime penalties.

They contact Social Security to try and put their Part B in place only to learn they have to wait for the general enrollment period that goes from January 1 to March 31, but the big shock is the Part B premium penalty they have to pay every month for the rest of their life.

On a regular basis, veterans tell us about the conflicting advice they received before calling us. A VA representative assured them their VA coverage would protect against Part B penalties. Their doctor at the VA told them they didn’t need Part B. In some cases, even a Social Security representative suggested they skip Medicare to save money since they have VA coverage.

While these professionals mean well, they often aren’t aware that Medicare options from private companies can help veterans keep their Part B premiums as low as possible, making coverage more affordable than they realize.

Veteran Medicare specialist insight: VA coverage is not creditable coverage for Medicare Part B penalty purposes. According to Medicare.gov, only employer group health plan coverage allows you to delay Part B enrollment without penalties, and VA coverage does not qualify (Source: Medicare.gov, https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/working-past-65).

Mistake #2: Thinking TRICARE for Life Replaces Medicare

TRICARE for Life doesn’t replace Medicare. It works alongside Medicare as wraparound coverage, also called secondary coverage. Without at least Medicare Parts A and B, TRICARE for Life simply doesn’t function. TRICARE for Life also provides wraparound coverage for Medicare Part C (Medicare Advantage).

Veteran Medicare specialist insight: Medicare (Parts A, B, or C) pays first, TFL covers what’s left, giving you virtually zero out-of-pocket costs.

Mistake #3: Dismissing Medicare Advantage (Part C) Plans

Some veterans think Medicare Advantage is only for civilians or that it will interfere with their VA benefits. This misconception costs them thousands in missed benefits.

Veteran Medicare specialist insight: Many Medicare options from private companies work well for those with VA benefits and/or TRICARE for Life. They don’t interfere with your military benefits. They enhance them with additional benefits that VA, Medicare, and TFL don’t provide while helping you avoid overpaying for Part B.

Mistake #4: Believing TRICARE for Life Won’t Work with Medicare Advantage (Part C)

This might be the most damaging misconception of all. Many veterans are told by TRICARE representatives, VA staff, or even generic Medicare advisors that “TRICARE for Life doesn’t work with Medicare Advantage plans” or that “you’ll lose your TRICARE benefits if you choose Part C.” This is completely false and costs veterans thousands in missed benefits.

According to the official TRICARE website, “If you enroll in a Medicare Advantage Plan, you still have Medicare. Medicare is still your primary coverage, and TRICARE For Life is the second payer for TRICARE-covered services” (Source: TRICARE.mil, https://tricare.mil/FAQs/TRICARE-with-Medicare/TRIMed_Advantage).

The only difference is that Medicare Advantage claims don’t automatically crossover to TRICARE, so you may need to file claims manually for TRICARE-covered services.

Real-world veteran Medicare specialists have an advantage over generalists. Specialists understand how the system actually works in practice, not just what’s written in a manual. Medical providers run businesses, and as they serve more Medicare-eligible patients, they’ve learned how to streamline billing for maximum reimbursement.

Most providers who work with TRICARE beneficiaries already know how to bill TRICARE for Life directly through Wisconsin Physician Services (WPS), which administers TFL. We haven’t had a client need manual claim forms in over two years because providers have streamlined their processes for Medicare beneficiaries and understand how to bill WPS for the TFL portion of the bill.

Veteran Medicare specialist insight: Many Medicare options from private companies offer significant benefits that veterans miss out on because of this misconception. These include ways to minimize Part B premiums and add additional benefits that VA, Medicare, and TRICARE for Life don’t provide. TRICARE for Life provides wraparound coverage for both Original Medicare and Medicare Advantage plans from private companies that contract with Medicare, allowing veterans to access these additional benefits while maintaining comprehensive coverage.

7. The Power of Veteran-Focused Guidance

When my team and I work with veterans, we don’t start with generic Medicare questions. We start with questions like:

- Do you have TRICARE Prime or Select? (if under 65)

- Do you have a spouse or children on your TRICARE Prime or Select?

- Do you have TRICARE for Life?

- What’s your VA priority group?

- Do you use Community Care?

- Do you have any level of disability?

- How far do you live from VA facilities?

- Do you get your prescription from a VA facility?

- If so, do you get them directly at a VA facility or through mail order?

- What percentage of your care do you get through the VA versus civilian providers?

- Do you travel frequently or spend time in multiple states?

These aren’t questions that generic Medicare advisors even know to ask, but they’re absolutely crucial for developing the right strategy for your situation. For example, a veteran who’s 100% service-connected and lives next to a VA medical center needs a completely different Medicare strategy than a veteran with 20% disability who uses VA care occasionally and travels frequently between states.

What really frustrates me is that I regularly see veterans who were told by generic advisors that “VA coverage means you don’t need Medicare” or “just get Original Medicare with a Supplement plan like everyone else.”

These advisors don’t understand that VA coverage provides no protection from Medicare Part B penalties, or that military retirees with TRICARE for Life are wasting thousands annually on unnecessary Medigap policies. They treat veterans like any other Medicare enrollee instead of recognizing the unique integration opportunities and financial benefits that military service has earned.

Veterans who work with specialists consistently end up with better outcomes including lower out-of-pocket costs, more comprehensive coverage, and Medicare strategies that enhance their military benefits instead of competing with them.

This is exactly what We Speak Veteran™ means in practice. We don’t just understand Medicare. We understand how your specific military situation changes everything about what makes sense for your Medicare strategy. We speak your language because we specialize exclusively in veterans, not because we slapped a military logo on generic Medicare advice.

8. Key Takeaways for Veterans

Let me recap the essential points every veteran needs to understand:

✓ Medicare is your nationwide safety net that works alongside (not instead of) your VA benefits and keeps TRICARE for Life active

✓ Part A is usually premium-free, Part B costs $185/month in 2025 and missing Part B enrollment can lead to costly lifetime penalties, according to the Centers for Medicare & Medicaid Services (Source: CMS.gov, https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles)

✓ Medicare Advantage (Part C) doesn’t cancel your VA or TRICARE benefits. It can enhance them while minimizing your Part B premiums

✓ You’ve already earned these benefits through decades of FICA taxes from military service and civilian work: you’re not asking for handouts, you’re collecting on an investment you’ve already made

✓ Generic Medicare advice consistently fails veterans: you need guidance from specialists who understand how military benefits change everything about your Medicare strategy

✓ The right strategy integrates all your benefits to create coverage that’s often better and less expensive than what civilian retirees can access

✓ TRICARE for Life and Medicare Advantage (Part C) work together effectively: Medicare Advantage pays first, then TRICARE for Life covers most or all of your remaining costs, often leaving you with zero out-of-pocket expenses

These aren’t just facts to memorize. They’re the foundation of a Medicare strategy that protects everything you’ve earned through your service.

9. What’s Coming Next

Now that you understand Medicare basics from a veteran’s perspective, Chapter 2 will dive into a crucial question: How exactly do VA health benefits and Medicare complement each other? Can they coexist without creating conflicts?

The answer is yes, and when integrated properly by someone who understands both systems, they create a powerful combination that gives you the best of both worlds.

I’ll show you how smart veterans use both systems strategically, the specific situations where Medicare fills critical gaps in VA coverage, including emergency care away from the VA and access to specialists when the VA can’t provide them quickly enough.

Most importantly, I’ll help you avoid the costly mistakes that generic Medicare advisors regularly make with veterans: mistakes that can cost you money every single month for the rest of your life.

Questions about how Medicare works with your specific VA or TRICARE benefits? My team and I help veterans navigate these decisions every day. Call us at 888-960-8387 (VETS) for personalized guidance that demonstrates what WE SPEAK VETERAN™ really means.