If you’re looking for veterans Medicare refunds, you’re not alone. In fact, most veterans don’t know that Medicare Part B refunds can return $25-$185 monthly, even as premiums increase in 2026.

The Shocking Math Every Veteran Needs to See

If you’re a veteran receiving VA disability or Social Security benefits, you’ve probably heard about the 2.7% COLA increase coming in 2026. Sounds like good news, right?

Here’s what they’re not advertising: Medicare is about to take almost half of it.

But what if I told you that my 81-year-old dad, a Vietnam-era veteran, actually gets $175 of his Medicare premium BACK every month through Medicare Part B refunds? Or that our average client gets $110 back? The truth is, there are veterans turning their Medicare bill into a monthly deposit through Medicare Part B refunds.

Most veterans have no idea Medicare Part B refunds exist. Unfortunately, the VA won’t tell you. Social Security won’t tell you either. Furthermore, 99% of Medicare agents don’t even know how Medicare Part B refunds work for veterans. See what other veterans discovered about these refunds.

Keep reading to discover the math that’s costing you thousands – and the simple solution hiding in plain sight.

The 2026 COLA Announcement: What Veterans Need to Know About Medicare Refunds

Understanding Your COLA Increase and Medicare Part B Refunds

The Social Security Administration announced a 2.7% cost-of-living adjustment for 2026. For veterans receiving both VA disability and Social Security, this should mean more money in your pocket.

However, here’s the reality check nobody’s talking about.

How Medicare Takes Your COLA: The Math Behind Veteran Medicare Savings

Breaking Down the Numbers: Medicare Refund for Veterans

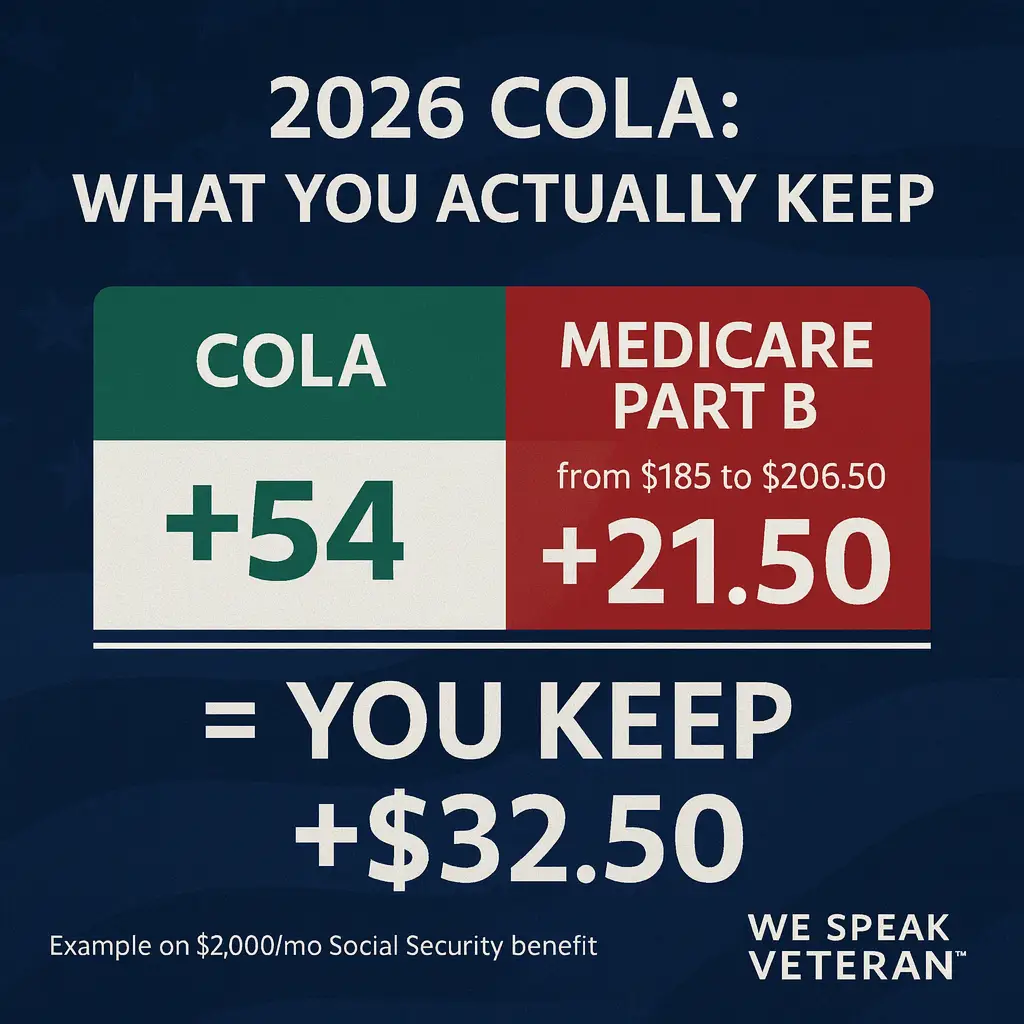

For a veteran receiving $2,000 monthly in benefits:

- Your COLA increase: $54/month

- Medicare Part B increase: $21.50/month (jumping from $185 to $206.50)

- What you actually keep: $32.50 (without Medicare Part B refunds)

That’s right. Medicare alone is devouring 40% of your raise before you even see it.

Why Veterans Can’t Skip Medicare

Here’s what shocks most veterans: The VA’s own website admits you need Medicare. Additionally, they state that funding for VA healthcare could change in the future. Even more concerning? VA coverage is not creditable for Medicare Part B.

What does this mean? If you delay enrollment, you’ll face a 10% penalty for every year you wait – permanently. Learn more about avoiding Medicare penalties.

The Reality Check

Consider this scenario: You’re 67, decided to skip Medicare Part B because you have VA coverage. Subsequently, you need care outside the VA system. Not only will you pay the current premium, but you’ll also pay an extra 20% penalty forever. Consequently, that’s an additional $41.30 monthly based on 2026 rates, or $495.60 yearly – forever.

How Veterans Medicare Refunds Work: Medicare Giveback Explained

My Dad’s $175 Part B Premium Reduction Story

My 81-year-old dad, Wallace, a Vietnam-era veteran, doesn’t worry about Medicare premium increases. Why? He gets $175 of his $185 premium back every month through veterans Medicare refunds. That’s $2,100 annually. Over five years, that’s $10,500 back in his pocket.

This isn’t a loophole or a scam. In fact, it’s called a Part B premium reduction, offered through certain Medicare Advantage plans specifically available to veterans.

Veterans Medicare Refunds: The Numbers Behind Medicare Giveback

Understanding Part B Premium Reduction Statistics

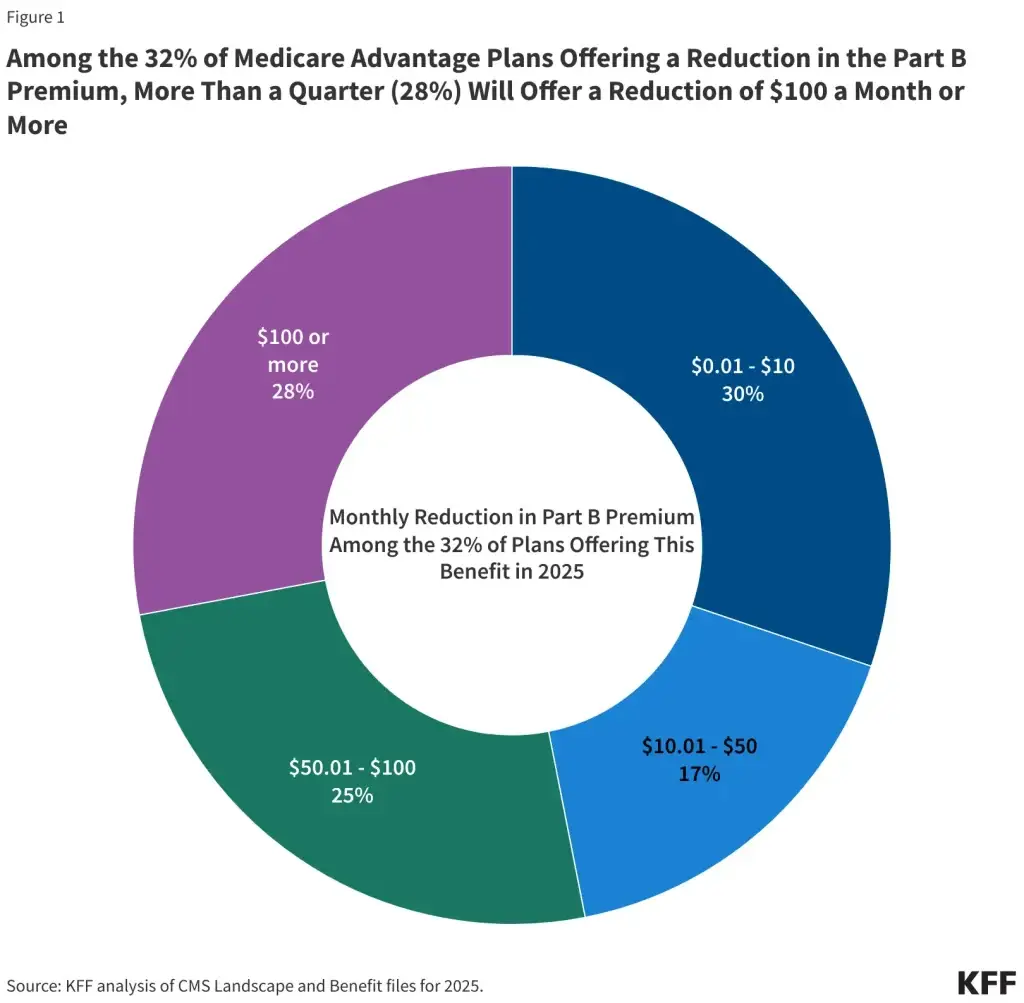

According to KFF, 32% of Medicare Advantage plans offered Part B premium reductions in 2025, up from just 19% the previous year. Our clients average $110 monthly back through veterans Medicare refunds – that’s $1,320 yearly.

When Medicare premiums increase to $206.50 in 2026, these refunds can increase too – potentially up to the full premium amount. As a result, veterans Medicare refunds are becoming more valuable as premiums rise.

Real Veteran Examples of Medicare Giveback Success

How Veterans Save with Part B Premium Reduction

- Marine veteran, 70% service-connected: Saves $150 monthly, uses VA for prescriptions, Medicare Advantage for everything else

- Air Force retiree with TRICARE: Gets $110 back monthly, keeps all TRICARE benefits

- Army veteran, rural location: Saves $85 monthly, can now see local doctors instead of driving 2 hours to VA

Who Needs to Pay Attention

If You Have TRICARE for Life

You must pay Medicare Part B or lose TRICARE entirely. No exceptions. However, with the right plan, you can get most or all of that premium back. Learn more about TRICARE for Life and Medicare refunds.

If You Only Have VA Benefits

The VA recommends Medicare as backup coverage. Without it, you can’t get care outside the VA unless they pre-authorize it. Moreover, miss that 72-hour emergency notification? You’re paying the full bill. Find out if you can have Medicare Advantage with VA benefits and get Medicare Part B refunds.

The FICA Connection Most Veterans Forget

Remember that FICA box on your paystubs? The average person making $50,000 annually for 40 years paid approximately $58,000 into Medicare. Therefore, you’ve already paid for these benefits – now it’s time to maximize them.

Think about it: You’ve contributed to Medicare your entire working life, including during military service. Now they want another $206.50 monthly? Getting refunds isn’t gaming the system – rather, it’s getting back what you’ve already paid for.

Critical Deadlines You Can’t Miss

Annual Enrollment Period: October 15 to December 7

- Miss this window, and you’re locked in for another year

- No special exceptions for “I didn’t know”

- The deadline doesn’t move for holidays or weekends

Initial Enrollment Period: 3 months before, month of, and 3 months after turning 65

- This is your one chance to avoid penalties

- VA coverage doesn’t extend this period

Three Factors Veterans Must Consider

1. Plan Compatibility

Not all Medicare Advantage plans work well with VA benefits. You need plans that:

- Understand VA won’t coordinate benefits

- Don’t require referrals for VA care

- Process military prescriptions correctly

2. Geographic Variations

Refund amounts vary dramatically by ZIP code:

- Urban areas: Often $150-175 monthly refunds

- Suburban areas: Typically $100-140 monthly

- Rural areas: Usually $25-85 monthly

3. Timing Matters

- Enrollment periods are strict

- Plan changes affect VA coordination

- Refunds start the month your plan begins

The Specialist vs. Generalist Difference: Why Medicare Giveback Requires Expertise

Here’s what most veterans don’t realize: 99% of Medicare advisors work with the general population. In fact, the average Medicare agent has less than 1% veteran clients. Consequently, they might see one veteran per year – meaning they rarely understand veterans Medicare refunds.

Veterans Advantage Financial works exclusively with veterans. Every client. Every day. Only veterans. Moreover, here’s the best part: Medicare regulations ensure all our services are completely free to veterans. As a result, you never pay a dime for expert help finding veterans Medicare refunds.

What Generalists Don’t Know About Part B Premium Reduction for Veterans

- VA coverage isn’t creditable for Part B

- TRICARE for Life coordination rules

- How Community Care actually works

- Service-connected disability impacts on coverage

- Which plans offer veteran-specific benefits

- How to maximize Part B premium refunds for veterans

Why This Matters for Medicare Refund for Veterans

When you’re the only veteran your agent sees all year, you’re their learning experience. However, when you work with specialists who only serve veterans, you’re getting expertise from thousands of cases exactly like yours.

Generic Medicare advice costs veterans thousands in missed refunds and wrong plan choices. On the other hand, specialist advice costs you nothing and saves you everything through veterans Medicare refunds.

The Free Service Veterans Don’t Know About

Medicare compensates agents through the insurance companies, not from veterans. Therefore, this means:

- Free plan comparisons tailored to your VA or TRICARE benefits for maximum veterans Medicare refunds

- Free enrollment assistance with zero pressure

- Free annual reviews to ensure you’re always getting the best veterans Medicare refunds

- Free refund maximization strategies for your ZIP code

You’ve already paid into Medicare through FICA taxes. Now let specialists who understand veterans help you get the most back through veterans Medicare refunds – at no cost to you. Additionally, check our testimonials to see real results.

The 2026 Impact Analysis

Let’s project forward. If current trends continue:

- Medicare Part B: $206.50 (confirmed)

- 2027 projection: $230+ (based on historical increases)

- Your COLA: Lucky to keep pace with inflation

- Result: Less purchasing power every year

Unless you know about Medicare Part B refunds and how to get them.

Start Getting Medicare Part B Refunds Today

Step 1: Calculate Your Veteran Medicare Savings Impact

Take your current benefit amount × 0.027 = Your COLA increase Subtract $21.50 = What you’ll actually keep Is that enough to cover your rising costs without Medicare Part B refunds?

Step 2: Research Your Medicare Giveback Options

- Find Medicare Advantage plans in your area offering veterans Medicare refunds

- Look specifically for “Part B premium reduction” or “giveback”

- Compare with your current coverage

Step 3: Understand Your Part B Premium Reduction Benefits

- Know how Medicare works with VA for veterans Medicare refunds

- Understand TRICARE for Life requirements

- Learn what’s creditable and what’s not

Step 4: Know Your Enrollment Window for Medicare Refund for Veterans

- Turning 65? You have 7 months to enroll and get veterans Medicare refunds (3 before, month of, 3 after birthday)

- Currently on Medicare? Annual Enrollment Period (October 15 – December 7) to change plans

- Enrolled in Medicare Advantage? Open Enrollment Period (January 1 – March 31) allows one plan change

- Important: Don’t confuse MA Open Enrollment with General Enrollment Period (same dates, different purpose)

- Penalties are permanent – 10% per year delayed

- Medicare Part B refunds only go to those in the right plans

Common Veteran Medicare Myths (Busted)

Myth: “VA coverage is all I need”

Truth: VA’s own website recommends Medicare

Myth: “Medicare Advantage limits my VA access”

Truth: You keep all VA benefits unchanged

Myth: “Part B refunds are too good to be true”

Truth: It’s on page 65 of Medicare’s official handbook

Myth: “I can enroll anytime since I’m a veteran”

Truth: Veterans follow the same enrollment rules

Don’t fall for these myths – learn about the top 5 Medicare mistakes veterans make and how to avoid them.

The Bottom Line

Your 2026 COLA increase doesn’t have to disappear into Medicare premiums. In fact, veterans who understand the system can actually benefit from these changes.

The math is simple:

- Do nothing: Keep $32.50 of your $54 raise

- Get refunds: Keep your entire raise plus get money back

Therefore, the question is: Will you be one of the veterans who knows this secret, or one of the 92% who doesn’t?

Chris Duncan is a Certified Medicare Insurance Planner™ and Retirement Income Certified Professional® with nearly 20 years of Medicare experience. His organization, Veterans Advantage Financial, works exclusively with veterans. He’s the author of “Medicare for Veterans: The Complete Field Guide.”

Get your free copy at www.FreeVetsBook.com

For personalized assistance finding Part B premium reductions in your area, call 888-960-VETS (8387). All services are free to veterans under Medicare regulations.

Resources and References

- VA.gov Emergency Care Guidelines

- Medicare.gov Premium Information

- KFF Medicare Advantage Analysis

- Medicare & You 2025 Handbook, Page 65

- CMS.gov for official Medicare statistics

This article is for informational purposes only and should not be considered personal financial or medical advice. Consult with a qualified Medicare specialist for guidance specific to your situation.