If you’re a veteran with a Purple Heart, former POW status, or a 10-20% service-connected disability rating, you’ve earned your place in VA Priority GIf you’re a veteran with a Purple Heart, former POW status, or a 10 to 20 percent service-connected disability rating, you’ve earned your place in VA Priority Group 3, and that comes with some serious health care advantages. But like many veterans, you might not fully understand what this designation means for your health care options, costs, and future planning.

I’m Chris Duncan, founder of Veterans Advantage Financial™. With nearly 20 years of Medicare experience, my team and I work exclusively with veterans. While we specialize in Medicare coordination, understanding your VA priority group is critical for comprehensive health care planning, especially as you approach 65. Let’s break down everything you need to know about Priority Group 3 benefits, so you can make informed decisions about your health care both now and as you approach retirement age.

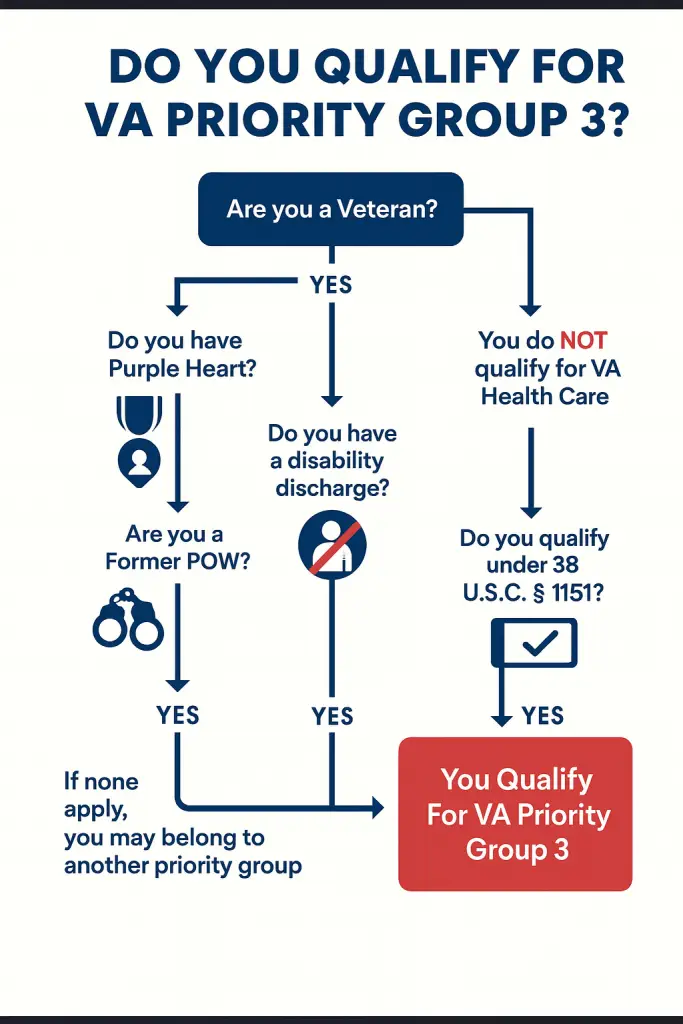

Who Exactly Qualifies for VA Priority Group 3?

Priority Group 3 isn’t just another bureaucratic category. It’s recognition of your service and sacrifice. The Department of Veterans Affairs places you in this mid-tier group based on specific criteria that set you apart from income-based applicants while acknowledging you’re not in the highest disability categories.

You’ll be assigned to Priority Group 3 if any of these situations apply to you:

Former Prisoner of War (POW): If you were captured and held by enemy forces during your service, you automatically qualify for Group 3, regardless of how long you were held or your current health status.

Purple Heart recipient: This prestigious award for wounds received in combat instantly places you in Priority Group 3, honoring the sacrifice you made for our country.

Disability discharge: If you were discharged specifically because of a disability that was caused or aggravated by your military service, you earn Group 3 status.

Service-connected disability rating of 10 or 20 percent: Veterans with these ratings from the VA are placed in Group 3, acknowledging that while your disabilities may not be as severe as higher-rated veterans, they still deserve priority care.

Title 38 U.S.C. § 1151 eligibility: This applies if VA medical treatment itself caused additional disability. Essentially, if the VA’s own medical care resulted in injury or worsening of your condition.

Military retirement pay offset: If your service-connected compensation is reduced because you’re receiving military retirement pay, or if you’re compensated at 10 percent for multiple 0 percent conditions that significantly impact your ability to work.

Here’s something important to remember: if you qualify for multiple priority groups, the VA will always assign you to the highest group for which you’re eligible. So if you later receive a 30 percent rating, you’d move up to Priority Group 2. You can learn more about all VA Priority Groups and the complete details in the Federal Benefits for Veterans guide.

WhWhat Health Care Benefits Come with Priority Group 3 Status?

Being in Priority Group 3 opens doors to significant cost savings and better access than lower-priority veterans receive. These benefits can save you thousands of dollars annually compared to civilian health care options.

Zero copays for service-connected conditions: Any treatment, medication, or service related to your service-connected disabilities comes at no cost to you. This includes outpatient visits, inpatient stays, emergency care, and specialty treatments.

Reduced urgent care costs: Your first three urgent care visits each calendar year are completely free, even if the issue isn’t related to your service-connected condition. This benefit alone can save hundreds of dollars compared to civilian urgent care costs.

Eliminated outpatient copays: Since every Priority Group 3 veteran has at least a 10 percent service-connected rating, you won’t pay any outpatient copays at all. This is a significant advantage over veterans in lower priority groups.

Inpatient care savings: Hospital stays for service-connected issues are free, while non-service-connected inpatient care carries reduced copays compared to Priority Groups 7 and 8.

Prescription drug benefits: Medications for service-connected conditions are free, and non-service-connected prescriptions are billed at the lowest VA pharmacy tier (currently capped at $11 for a 30-day supply or $33 for a 90-day supply of brand-name medications). You can check the current VA Copay Rates for the most up-to-date pricing.

Priority scheduling: You’ll get appointment priority over veterans in Priority Groups 4 through 8, which can significantly reduce wait times for specialty clinics, diagnostic procedures, and routine care.

Access to VA’s full network: You can receive care at any VA medical facility nationwide, and in many cases, you’re eligible for community care if VA can’t provide timely access to the services you need.

These benefits become even more valuable as you age and your health care needs increase. Many veterans don’t realize how much money they’re saving until they compare notes with friends using civilian health care or other government programs.

Do Priority Group 3 Veterans Ever Pay Copays?

The short answer is: rarely, and when you do, it’s significantly less than what you’d pay elsewhere.

You’ll never be charged for care that treats a service-connected disability. That’s a promise the VA keeps. However, there are limited situations where you might see some costs:

Non-service-connected care: If you visit the doctor for something completely unrelated to your rated conditions (like a routine skin cancer screening or treatment for a cold), you might encounter small copays. Even then, these are substantially lower than what you’d pay in the civilian world.

Excess urgent care visits: After your third urgent care visit in a calendar year, standard copays apply for visits unrelated to service-connected conditions.

Non-service-connected prescriptions: Medications not related to your rated disabilities fall under the VA’s standard pharmacy copay structure, but again, these are among the lowest prescription costs available anywhere.

Here’s the safety net many veterans don’t know about: if your household income drops below the VA’s geographically adjusted income threshold, even these minimal copays can be waived entirely. It’s worth checking your eligibility annually, especially if you’re approaching retirement. Learn more about Your Health Care Costs and potential waivers.

For context, many Priority Group 3 veterans report annual out-of-pocket VA costs under $200, compared to thousands they might spend on civilian health insurance premiums alone. As you plan for retirement and potentially transition away from employer-sponsored health coverage, understanding these costs becomes crucial for your financial planning.

How Does Priority Group 3 Compare to Other Priority Groups?

Understanding where you fit in the VA’s priority system helps you appreciate your benefits and plan for potential changes as your health or circumstances evolve.

Priority Groups 1 & 2 (the highest): These veterans have 30 to 100 percent service-connected ratings, Medal of Honor recipients, and those with catastrophic disabilities. They receive all care and medications free, plus additional benefits like dental care, travel pay, and enhanced prosthetics.

Priority Group 3 (your group): You receive free service-connected care, reduced non-service-connected costs, priority scheduling, and access to most VA services. You’re in the “sweet spot” with significant benefits without some of the intensive medical monitoring required for higher-rated veterans.

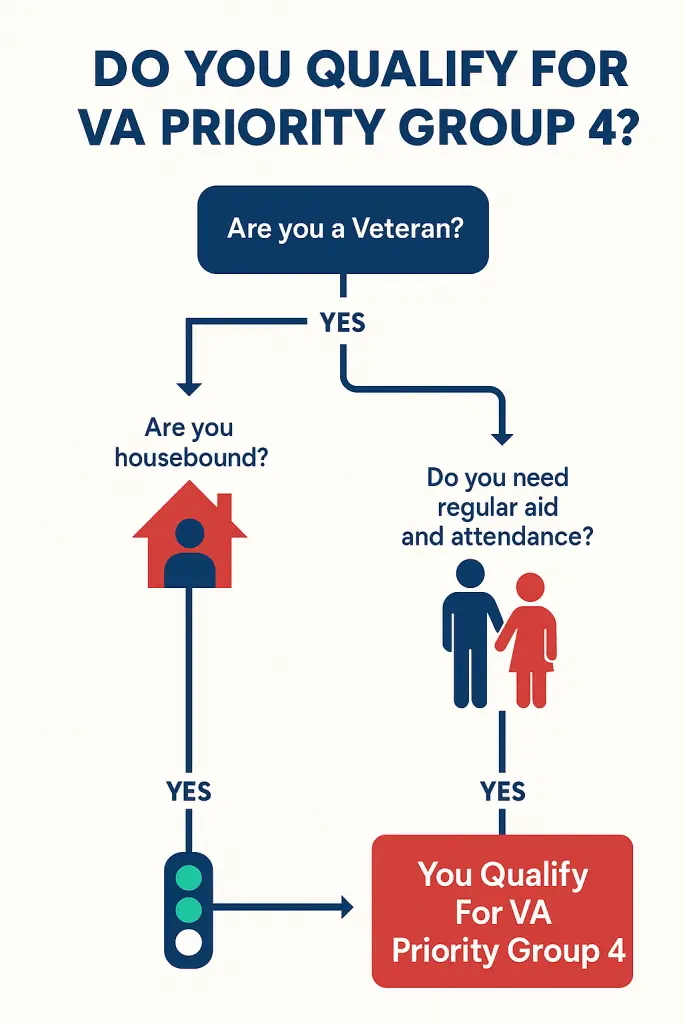

Priority Groups 4 & 5: These include veterans receiving Aid and Attendance benefits, those with low incomes, and veterans receiving VA pensions. While they receive good care, their copays are higher than yours for non-service-connected issues.

Priority Groups 6, 7 & 8: Lower priority groups face higher copays and, in the case of Group 8, may have enrollment suspended during budget constraints. Group 6 includes veterans with 0 percent ratings but special exposures (Agent Orange, burn pits, etc.). You can read more about all VA Priority Groups and review the complete Federal Benefits for Veterans guide for detailed comparisons.

Your Priority Group 3 status provides an excellent balance of comprehensive benefits without the extensive medical oversight that comes with higher disability ratings. Many veterans find this level of care meets all their needs while allowing them flexibility in their health care planning.

Does PrDoes Priority Group 3 Include Dental and Vision Coverage?

This is where many veterans get surprised. Priority Group 3 doesn’t automatically include comprehensive dental coverage.

Dental coverage reality: Routine dental care requires either a 100 percent service-connected rating, recent service-connected dental trauma, or qualification under one of 17 specific dental eligibility categories. Most Priority Group 3 veterans don’t qualify for comprehensive VA dental benefits.

However, you’re not left without options. The VA Dental Insurance Program (VADIP) offers discounted dental coverage specifically for veterans. While it’s not free, it provides affordable dental insurance that many veterans find more cost-effective than civilian alternatives. You can learn more about all VA Dental Care options and eligibility requirements.

Vision care: Eye exams and corrective lenses are covered when they’re needed to treat a service-connected condition. For non-service-connected vision needs, you may pay modest copays, but these are typically much lower than civilian costs.

Pro tip: If you have any service-connected conditions that could reasonably relate to vision or dental issues, discuss this with your VA provider. Sometimes conditions are more connected than they initially appear, and proper documentation could expand your coverage.

As you plan for retirement, dental and vision costs can add up significantly. Understanding these limitations helps you budget appropriately and consider supplemental coverage options that work with your VA benefits.

How Do I Apply for VA Health Care and Confirm My Priority Group?

If you’re not already enrolled in VA health care, or if you want to confirm your priority group assignment, the process is straightforward.

Application process: Complete VA Form 10-10EZ, which you can submit online at VA.gov, mail in, or complete in person at any VA medical center. The online application is typically the fastest, with most approvals processed within a week. Get started with the step-by-step guide on How To Apply For VA Health Care.

Required documentation: Gather proof of your qualifying status (Purple Heart certificate, POW documentation, VA rating decision letter, or discharge papers showing disability discharge). If this information is already in VA files, you may not need to resubmit it. You can find helpful information about keeping proper documentation on our Medicare and VA Forms page.

Confirmation: VA will send you a written decision letter showing your priority group assignment. You can also view this information in your My HealtheVet account or on VA.gov once you’re enrolled.

Getting started: Once enrolled, you can begin receiving care immediately at any VA facility. Your first step should be establishing care with a primary care provider who can help coordinate all your VA benefits.

Important timing note: While VA health care doesn’t have the same enrollment periods as some other health programs, getting enrolled sooner rather than later ensures you’re established in the system and can access care when you need it. This becomes particularly important as you approach age 65 and begin thinking about your comprehensive health care strategy, including how VA benefits coordinate with Medicare.

Can I Move from Priority Group 3 to a Higher Priority Group?

Absolutely, and it’s more common than you might think. Your priority group isn’t set in stone. It can change based on your health status and VA ratings.

Rating increases: If your combined service-connected rating increases to 30 percent or higher, you’ll automatically move to Priority Group 2 (30 to 40 percent) or Priority Group 1 (50 percent and above). This upgrade brings additional benefits like free dental care and enhanced travel benefits.

PACT Act opportunities: The recent PACT Act has expanded presumptive conditions for veterans exposed to burn pits, Agent Orange, and other toxic substances. Many veterans are discovering they qualify for new service-connected ratings based on conditions they didn’t know were connected to their service. Check your VA Eligibility to see if new presumptive conditions apply to you.

When to file for increases: Consider filing a claim for increase if any of your service-connected conditions have worsened, if you’ve developed new symptoms that might be related to your service, or if new medical evidence supports a higher rating.

Secondary conditions: Sometimes conditions develop as a result of your already-rated disabilities. These secondary conditions can also be service-connected and contribute to a higher overall rating.

The process: Contact a Veterans Service Organization (VSO) or VA-accredited representative to help evaluate whether you might qualify for rating increases. They can review your medical records and help determine the best approach for your situation.

Moving to a higher priority group means more benefits and lower costs. Even if you’re satisfied with your current care, it’s worth periodically reviewing whether you might qualify for upgrades to your benefits.

What Paperwork Should You Keep After Enrollment?

Staying organized with your VA documentation saves time and prevents headaches down the road. Keep these essential documents easily accessible:

Your VA enrollment letter showing Priority Group 3 status. You’ll need this for various purposes, including coordination with other health coverage as you age.

Latest rating decision letter proving your 10 to 20 percent service-connected disability rating or other qualifying status. This document is crucial for travel benefits, community care authorizations, and benefit verification.

Service medals and awards documentation, particularly your Purple Heart certificate or POW documentation, as these may be needed for benefit expansions or appeals.

Copay receipts and statements for tax purposes and potential reimbursement disputes. While Priority Group 3 veterans typically have minimal copays, keeping track helps with medical expense deductions.

Annual income verification if you’ve ever claimed financial hardship for copay waivers. Updating this information can sometimes eliminate copays entirely.

Insurance information for any other coverage you have. VA can often bill other insurance first, preserving your VA benefits and sometimes resulting in refunds.

Digital copies stored securely in the cloud ensure you never lose important documents, and having physical copies available prevents delays when you need immediate verification of your benefits. For more information on important forms and documentation, visit our Medicare and VA Forms resource page.

What Are the Biggest Mistakes Priority Group 3 Veterans Make?

Learning from others’ mistakes can save you money and frustration. Here are the most common errors veterans in your priority group make:

Assuming all care is free: While service-connected care is free, some non-service-connected services may have small copays. Understanding this prevents surprise bills and helps with budgeting.

Ignoring annual income updates: Your income affects certain benefits and copay waivers. A simple annual update could eliminate costs you’re currently paying.

Not filing for rating increases: Many veterans accept their initial rating without considering that conditions often worsen over time or that new presumptive conditions become available.

Forgetting about dental coverage: Since routine dental isn’t included, many veterans neglect their oral health or pay high civilian costs instead of exploring VADIP or other affordable options.

Not reporting other insurance: Whether it’s employer coverage, Medicare, or other insurance, reporting this to VA can sometimes result in the other insurance paying first, preserving your VA benefits. Learn how to Update Your Health Information to keep your records current.

Skipping preventive care: Priority Group 3 provides excellent access to preventive services. Using these benefits helps catch problems early when they’re easier and less expensive to treat.

Not understanding community care options: If VA can’t provide timely access to needed care, you may be eligible for community care at VA expense. Many veterans don’t realize this option exists.

Poor record keeping: Not maintaining organized files of VA correspondence, rating decisions, and medical records can cause delays and complications when you need to access benefits or file claims.

Not planning for Medicare at 65: Many Priority Group 3 veterans don’t realize that VA coverage is NOT creditable coverage for Medicare Part B. Delaying Medicare enrollment can result in lifetime penalties. For more information, see our Veterans Medicare FAQ.

Understanding these pitfalls helps you maximize your benefits while avoiding unnecessary costs and complications.

Key Takeaways for Priority Group 3 Veterans

Your Priority Group 3 status represents significant value and recognition for your service. Here’s what you need to remember:

Your eligibility stems from meaningful service: Purple Heart awards, POW status, 10 to 20 percent service-connected ratings, disability discharges, or special circumstances that set you apart from income-based applicants.

Cost advantages are substantial, with free service-connected care, minimal copays for other services, and priority access that can save both time and money compared to civilian alternatives.

Growth potential exists through rating increases, new presumptive conditions, and benefit expansions that could move you to even higher priority groups with additional benefits.

Planning importance increases as you age, particularly as you approach retirement and need to coordinate VA benefits with other health coverage options like Medicare.

Preventive focus helps you maintain health while taking advantage of your priority access to VA’s comprehensive services.

Documentation matters for maximizing benefits, supporting future claims, and ensuring smooth coordination with any other health coverage you might have.

Regular reviews of your benefits, ratings, and health status can uncover opportunities for improved care or additional benefits you might be missing.

Final Thoughts

Priority Group 3 represents what many consider the optimal balance in VA health care: substantial benefits without the intensive medical oversight required for higher disability ratings. Your Purple Heart, POW status, service-connected rating, or qualifying discharge earned you this recognition, and the benefits that come with it can provide excellent health care value for decades to come.

The key to maximizing these benefits lies in understanding how they work, staying current with changes in VA policy, and planning proactively for your future health care needs. Whether you’re currently in your 40s and planning ahead, or approaching retirement age and coordinating multiple health coverage options, your Priority Group 3 benefits provide a solid foundation for your health care strategy.

Take advantage of the preventive care, specialty services, and cost savings available to you. Stay informed about new presumptive conditions and benefit expansions that might affect you. And remember that your benefits are designed to grow with your needs, both through natural progression and through advocacy for additional service-connected conditions when appropriate.

Your service earned you these benefits. Make sure you’re getting everything you’re entitled to receive.

Understanding how Priority Group 3 benefits work with Medicare as you approach 65 can be complex.

At Veterans Advantage Financial™, my team and I work exclusively with veterans. Medicare rules enable us to provide our services completely free to veterans. We help you understand how your VA benefits coordinate with Medicare to avoid penalties and maximize your coverage.

Call 888-960-8387 (VETS) if you have questions about coordinating your Priority Group 3 benefits with Medicare planning.

Written by Chris Duncan, Veterans Advantage Financial™. We specialize in helping veterans maximize their benefits and avoid costly mistakes. Visit our website at veteransadvantagefinancial.vet or check out our Veterans Medicare FAQ for more information.