Author: Christopher Duncan, Certified Medicare Insurance Planner™ | Retirement Income Certified Professional®

Veterans TSP after retirement represents a critical gap in military financial planning, but the new FORWARD Act could change everything. Currently, when you separate from service, your ability to contribute to the Thrift Savings Plan ends abruptly. However, this bipartisan legislation would revolutionize how retired veterans TSP contributions work, allowing continued savings during peak earning years.

Furthermore, with nearly 20 years of Medicare experience, my team and I at Veterans Advantage Financial specialize exclusively in helping veterans navigate complex benefit decisions. Indeed, this proposed legislation represents one of the most significant opportunities for veteran financial planning in decades.

The FORWARD Act: Revolutionary Change for Military TSP After Retirement

First, Representatives Jen Kiggans (R-VA) and Wesley Bell (D-MO) introduced the Financial Opportunities for Retirees and Warriors Advancing Retirement Development (FORWARD) Act on August 19, 2025 (Source: Kiggans.house.gov). Consequently, this FORWARD Act veterans TSP legislation would allow retired veterans TSP contributions to continue, fundamentally changing retirement planning for military families.

Moreover, the average enlisted member retires at 42.1 years old, while officers average 46.5 years old (Source: Congressional Research Service via PLANSPONSOR). Therefore, this creates a 17-year dead zone before accessing TSP funds without penalties at age 59½.

Who Benefits from Retired Veterans TSP Access Through the FORWARD Act

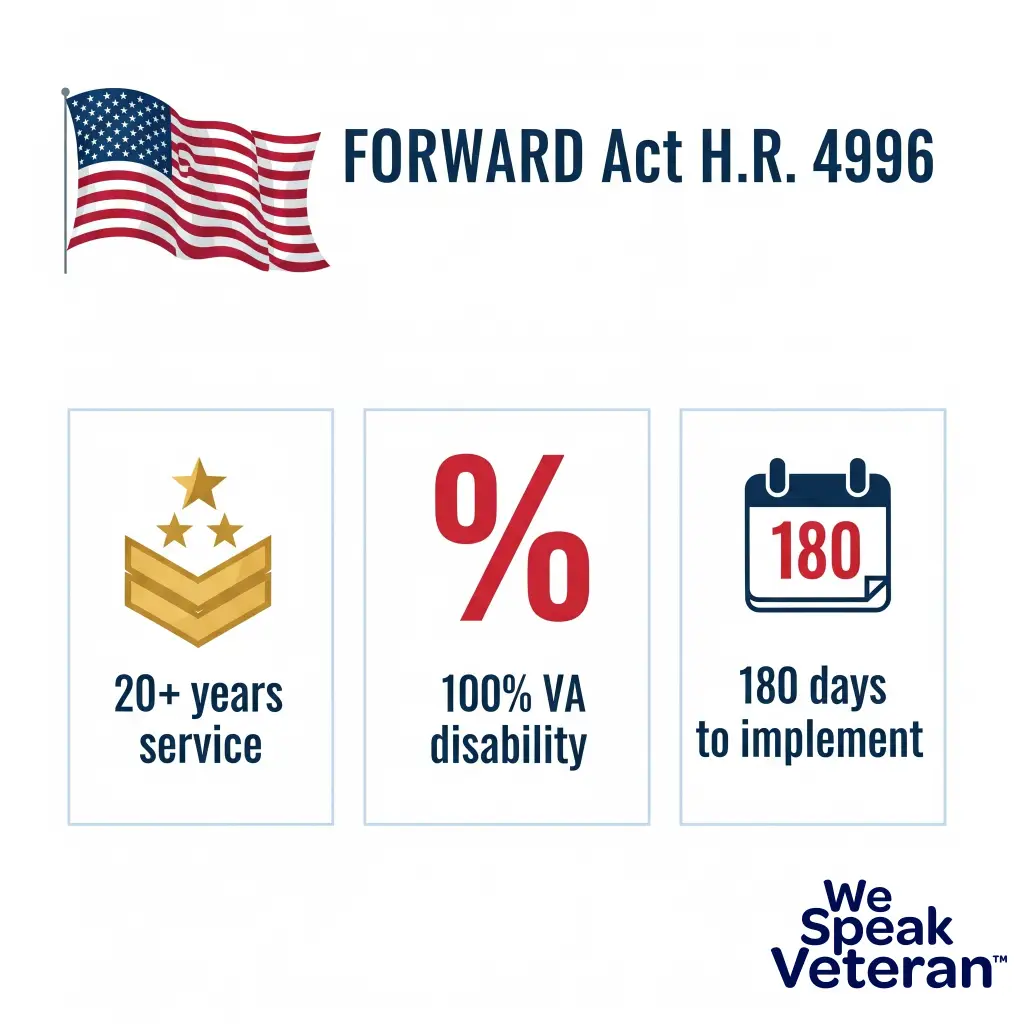

Specifically, the FORWARD Act (H.R. 4996) for TSP for retired military helps:

- Veterans receiving military retirement pay (20+ year retirees)

- Veterans with 100 percent VA disability ratings who had TSP accounts during service

- Additionally, military families seeking to maximize retirement savings during peak earning years

Related Resource: Understanding how VA benefits work with Medicare coverage

Understanding Your Three-Legged Military Retirement Savings Plan

Generally, military retirees rely on three income sources, and veteran retirement TSP plays a crucial role in veteran retirement planning:

1. Military Retirement Pay

First and foremost, this starts immediately upon retirement, providing 40-50 percent of highest basic pay. Subsequently, average enlisted retirees receive $30,000-$35,000 annually, while officers average $60,000-$70,000 (Source: U.S. News Money).

2. Social Security Benefits

Next, veterans can claim reduced benefits at 62 or full benefits at 67. However, the gap between military retirement at 42 and Social Security at 62 spans two decades. For more information about how military retirement affects Social Security benefits, many veterans don’t realize their military pension won’t reduce their Social Security payments. Veterans should also understand whether they can collect military retirement, VA disability, and Social Security simultaneously (Source: USA.gov Military Pensions).

3. TSP and Personal Savings

Finally, without penalty-free access until 59½, veterans TSP after retirement becomes a waiting game. Unfortunately, under current law, you cannot add to it during your highest earning civilian years.

The Medicare Connection Veterans Must Understand

Importantly, at age 65, Medicare automatically enrolls you if you’re receiving Social Security. As a result, the Part B premium ($185 in 2025, projected $206.50 in 2026) gets deducted directly from your Social Security check. My 82-year-old father, Wallace Duncan, a Vietnam-era veteran, uses Medicare strategies specifically designed for veterans that maximize his benefits while minimizing his costs. These veteran-specific approaches can significantly impact your net retirement income. Veterans approaching 65 should understand their complete Medicare enrollment options to take full advantage of available strategies.

Important: Alternatively, if you’re not drawing Social Security at 65, Medicare sends quarterly bills or you can arrange automatic bank drafts (Source: Medicare.gov).

The Power of Continued TSP Contributions for Veteran Retirement Planning

For example, consider a 42-year-old military retiree contributing $500 monthly from retirement pay under the proposed military TSP after retirement rules:

- First: Total contributions over 17 years: $102,000

- Then: With 7% average returns: Approximately $220,000

- Finally: Additional tax-deferred growth until withdrawal

Furthermore, the 2025 TSP contribution limits veterans face are $23,500, or $31,000 for those 50+ with catch-up contributions (Source: TSP.gov). Therefore, veterans with 100 percent disability ratings receiving $3,500+ monthly VA compensation could significantly impact their military retirement savings plan through continued TSP for retired military contributions.

Why TSP Remains Superior to Other Military Retirement Savings Plan Options

Above all, veteran retirement TSP access through the FORWARD Act veterans TSP legislation preserves these advantages:

- First: Ultra-Low Fees – Expense ratios between 0.048-0.079 percent (Source: Kiplinger)

- Second: G Fund Security – Treasury returns with no loss risk

- Third: Simple Choices – Five core funds plus lifecycle options

- Finally: Tax Flexibility – Traditional or Roth options

Additionally, over 2 million military members have TSP accounts, with 171,023 federal TSP participants achieving millionaire status as of June 2025 (Source: FedSmith).

Bridging the 17-Year Gap: Alternative Military Retirement Savings Plan Strategies

Meanwhile, while waiting for the FORWARD Act veterans TSP access to become law, consider these veteran retirement planning strategies. Understanding TSP contribution limits veterans currently face helps in planning alternative approaches:

Multi-Year Guaranteed Annuities (MYGAs)

In particular, MYGAs offer guaranteed fixed returns that can help bridge the retirement gap:

- Guaranteed rates: 5.8-6.6 percent for 5-year terms (August 2025)

- Moreover, no contribution limits unlike TSP’s $23,500 cap

- Additionally, tax-deferred growth similar to TSP

- Finally, 10 percent annual penalty-free withdrawals

For veterans seeking predictable, fixed annuity returns, MYGAs provide a stable foundation while maintaining flexibility through annual withdrawal provisions.

The Ladder Strategy

Subsequently, create staggered maturity dates:

- Initially, a 5-year MYGA maturing at age 47

- Then, a 7-year MYGA maturing at age 49

- Next, a 10-year MYGA maturing at age 52

- Finally, another 7-year MYGA at 52, maturing at 59

Note: However, MYGAs are insurance products backed by company claims-paying ability, not FDIC insured (Source: The Annuity Expert).

Current Bill Status and What Veterans Should Do

Currently, the FORWARD Act awaits scheduling by the House Committee on Oversight and Government Reform (Source: NAPA-Net). Consequently, implementation would occur within 180 days of passage.

Action Steps for Veterans:

- First, monitor progress at Congress.gov (H.R. 4996)

- Second, contact your representatives to express support

- Third, review current retirement planning strategies, including understanding MYGA options for bridging the gap

- Finally, consider interim solutions while awaiting passage

Expert Analysis: Why Veterans TSP After Retirement Matters

Notably, Representative Kiggans, a former Navy pilot, stated: “For our 20-year retirees and veterans with a 100% disability rating, it’s only fair that they can keep contributing to the Thrift Savings Plan they’ve spent years building.” This FORWARD Act veterans TSP legislation addresses critical gaps in veteran retirement planning.

Furthermore, the average American needs approximately $1.26 million for comfortable retirement according to Northwestern Mutual’s 2025 Planning & Progress study (Source: Northwestern Mutual via FedSmith). Therefore, military TSP after retirement access combined with understanding TSP contribution limits veterans face could be crucial for reaching retirement goals through a comprehensive military retirement savings plan.

Get Your Complete Veterans Benefits Strategy

Ultimately, understanding how veterans TSP after retirement fits into your overall benefits picture requires specialized expertise. Indeed, with nearly 20 years helping veterans navigate Medicare and retirement planning, Veterans Advantage Financial provides guidance designed exclusively for military families.

Free Resources:

- Complete Medicare Field Guide for Veterans

- Fixed Annuity Options for Retirement Planning

- Social Security Benefits for Military Retirees

In conclusion, for personalized guidance on maximizing your veteran benefits and retirement planning, call 888-960-8387 (VETS). Moreover, our services are free to veterans – you pay the same Medicare costs whether you work with us or go directly to insurance companies.

Keywords: veterans TSP after retirement, FORWARD Act, military retirement TSP, veterans retirement savings, TSP contributions after military service, veteran financial planning, Multi-Year Guaranteed Annuities, fixed annuity for veterans, Medicare for veterans, Social Security for retired veterans, FORWARD Act veterans TSP, military retirement savings plan, TSP contribution limits veterans, veteran retirement planning, retired veterans TSP, TSP for retired military, veteran retirement TSP