Medicare for Veterans: The Complete Field Guide

How to Maximize Your Military Benefits and Avoid Costly Medicare Mistakes

Christopher Duncan

Veterans Advantage Financial™

Copyright © 2025 Christopher Duncan and Veterans Advantage Financial™

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

Disclaimer: This guide contains Medicare information current as of January 2025. Medicare rules, costs, and benefits change annually. Always verify current information with official sources. This guide provides educational information only and should not be considered personal financial, insurance, or medical advice. Individual situations vary, and you should consult with qualified professionals for guidance specific to your circumstances.

Veterans Advantage Financial™ is an independent insurance agency not affiliated with the federal government, Medicare, the Department of Veterans Affairs, or TRICARE.

For personalized assistance: 888-960-8387 (VETS)

Connect with us:

- YouTube: https://www.youtube.com/@ChrisDuncan-WeSpeakVeteran

- Facebook: https://facebook.com/veteransadvantagefinancial

- Instagram: https://www.instagram.com/wespeakveteranchrisduncan/

- TikTok: https://www.tiktok.com/@christopherduncanvaf

- X/Twitter: https://x.com/wespeakveteran

Dedication

To every veteran who has served our country and now faces the complex maze of Medicare decisions: This guide is for you.

Your service earned these benefits. This field guide ensures you receive every advantage available to you.

Acknowledgments

This guide exists because of the thousands of veterans who have trusted my team and me with their Medicare decisions over the years. Your stories, challenges, and successes shaped every page.

Special thanks to:

My team at Veterans Advantage Financial™, especially Jeff Clericuzio, my lifelong friend of over thirty years, and Dana Fike, my brother-in-law who has known me since I was about eight years old. Their dedication demonstrates daily what it means to serve those who served. When you work with people who’ve known you most of your life, there’s a level of trust and accountability that ensures we always do right by our veteran clients.

The veterans who shared their experiences for this guide, allowing others to learn from both their successes and costly mistakes.

My wife Claudia, a dedicated ICU nurse for over 30 years, whose unwavering support makes this mission possible. While she doesn’t work directly in the business, her deep understanding of healthcare, her patience with my long hours building Veterans Advantage Financial™, and her steadfast belief in our mission to serve veterans have been the foundation of every success. After three decades of saving lives and comforting families in their darkest moments, she understands better than anyone why helping veterans navigate healthcare decisions matters. Her strength, wisdom, and endless encouragement remind me daily that behind every successful mission is someone who believes in you when the path gets difficult.

Wallace Duncan, my father, whose Vietnam-era service and practical wisdom inspired this entire mission. As I’ve grown into adulthood, our relationship has deepened in ways I never expected. His journey through Medicare as a veteran, including his success with ensuring he’s not overpaying for Part B, provides daily proof that these strategies work. At 82, he continues to teach me about resilience, humor, and the importance of taking care of those who served. His willingness to share his story, including his famous quote “The VA is great, but it ain’t perfect,” helps countless veterans understand why they need both VA benefits and Medicare. Every time I help a veteran maximize their benefits, I’m extending the lessons he’s taught me about service, family, and doing right by others.

Harvey and Norma Robbins, my grandparents who raised me and gave me the foundation for everything I’ve become. Though not biological, they were my true grandparents in every way that matters. Harvey, a World War II Army veteran and California Highway Patrol officer, showed me what service, integrity, and dedication truly mean. His steady presence shaped my deep respect for veterans and my commitment to doing things the right way. Norma provided the love, guidance, and structure that helped me build a life of purpose. Though they rest together at the Northern Nevada Veterans Memorial Cemetery, their lessons about honor and hard work guide my mission to serve veterans every day.

Richard Fochtman, my friend of over 20 years and a 100% disabled Vietnam veteran, whose dedication to helping fellow veterans navigate these complex systems exemplifies the spirit of service that continues long after the uniform comes off.

Every VA representative, TRICARE specialist, and Medicare professional who genuinely tries to help veterans navigate these complex systems.

Most importantly, thank you to every veteran reading this. Your service earned these benefits. My mission is simply to ensure you receive every advantage available to you.

About This Guide

After nearly 20 years in the Medicare industry, now working exclusively with veterans, I’ve seen the same costly mistakes repeated thousands of times. Veterans receive generic Medicare advice that ignores their unique military benefits, miss opportunities worth tens of thousands of dollars over retirement, and face penalties that could have been easily avoided.

This guide exists because you deserve better.

Who This Guide Is For:

- Veterans approaching age 65 who need to make Medicare decisions

- Military retirees with TRICARE for Life navigating Medicare requirements

- Veterans already on Medicare who suspect they’re missing benefits

- Family members helping veterans make healthcare decisions

- Any veteran tired of generic Medicare advice that ignores military benefits

What Makes This Different:

This isn’t another Medicare guide with a military logo slapped on the cover. Every strategy, example, and piece of advice comes from real experience helping veterans maximize their specific benefits. You’ll learn how Medicare works alongside your VA healthcare and TRICARE benefits, not instead of them.

How to Use This Guide:

While designed to be read cover to cover, you can jump to chapters that address your immediate needs:

- Approaching 65? Start with Chapter 1 for Medicare basics, then Chapter 8 for enrollment

- Already have Medicare? Chapter 5 reveals opportunities to avoid overpaying for Part B

- Have TRICARE for Life? Chapter 3 is essential reading

- Concerned about penalties? Chapter 6 shows how to avoid them

- Want real examples? Chapter 10 shares success stories from veterans like you

Remember: You’ve already paid for Medicare benefits through decades of FICA taxes. You’ve earned VA benefits through your service. This guide shows you how to maximize both.

Quick Reference Guide

If You Need Help NOW:

Turning 65 in the next 3 months? → Read Chapter 8 immediately for enrollment guidance → Call 888-960-8387 (VETS) for personalized assistance

Already have Medicare but paying too much? → Start with Chapter 5 on avoiding overpaying for Part B → Review Chapter 7 on costly mistakes to fix

Have TRICARE for Life? → Chapter 3 explains why Medicare Parts A & B are mandatory → Learn how TFL provides wraparound coverage for Medicare options from private companies

Using VA healthcare? → Chapter 2 shows how Medicare fills critical gaps → Understand why VA coverage alone isn’t enough

Worried about penalties? → Chapter 6 reveals why VA coverage doesn’t protect you → Learn the real enrollment deadlines that matter

Critical Dates to Remember:

- Initial Enrollment Period: 3 months before through 3 months after turning 65

- Annual Election Period: October 15 – December 7

- Medicare Advantage Open Enrollment: January 1 – March 31

- General Enrollment Period: January 1 – March 31 (with July 1 start)

Key Facts Veterans Must Know:

✓ VA coverage is NOT creditable for Medicare Part B penalties ✓ TRICARE for Life REQUIRES both Medicare Parts A and B ✓ Medicare Advantage plans work WITH military benefits, not against them ✓ Opportunities to ensure you’re not overpaying for Part B means more money stays with you each month ✓ You pay the same Medicare costs whether you work with a specialist or go alone

Important Notice

Medicare Information Currency: This guide reflects Medicare rules, costs, and benefits as of January 2025. Medicare regulations change annually. Always verify current information with official sources.

Not Personal Advice: This guide provides educational information to help you understand Medicare options. Your situation is unique. For personalized guidance based on your specific military benefits, health needs, and financial situation, consult with qualified professionals.

Free Veteran Services: Veterans Advantage Financial™ provides all Medicare guidance services free to veterans. Medicare rules allow us to receive standard compensation from Medicare plans, meaning you pay exactly the same whether you work with us or go directly to insurance companies.

Your Benefits, Your Choice: This guide empowers you to make informed decisions. Whether you work with us, another professional, or navigate Medicare independently, you now have veteran-specific knowledge to maximize your earned benefits.

Questions? My team and I are here to help at 888-960-8387 (VETS).

We Speak Veteran™ because your service deserves specialized support.

TABLE OF CONTENTS

Acknowledgements

Introduction

Chapter 1 — Medicare Basics for Veterans

Everything you need to know to get started

- Medicare at a Glance—What It Really Means for Veterans

- The Four Parts: Decoded for Veterans

- Where the Money Comes From: You’ve Already Paid Your Dues

- Three Critical Reasons Veterans Cannot Ignore Medicare

- Where Generic Medicare Advice Falls Short for Veterans

- Common Mistakes Veterans Make (And How Specialists Help You Avoid Them)

- The Power of Veteran-Focused Guidance

- Key Takeaways for Veterans

- What’s Coming Next

Chapter 2 — VA Health Benefits vs. Medicare

Why relying on the VA alone can leave dangerous gaps

- Let’s Talk About How VA Health Care Really Works

- Where Medicare Fits Into Your Healthcare Strategy

- Why Generic Medicare Advisors Miss the Point

- The Smart Strategy: Layer VA + Medicare for Full Protection

- The Independence Factor: Why It Matters

- Common Myths That Cost Veterans Money

- Financial Reality Check: VA-Only vs. Strategic Integration

- Key Takeaways

- What’s Coming Next

Chapter 3 — TRICARE for Life and Medicare

How military retirees keep world-class coverage, and why Parts A & B are absolutely mandatory

- Do You Qualify for TRICARE for Life?

- Why Medicare Parts A & B Are Absolutely Non-Negotiable

- How Your Medicare Coverage and TFL Work as a Perfect Team

- Real Example: How It Works

- The Generic Advisor Mistake: Selling Unnecessary Medigap

- Medicare Advantage (Part C) with TRICARE for Life: A Powerful Combination

- Where Generic Advisors (and Even TFL Guidance) Get TRICARE for Life Wrong

- Key Takeaways for Military Retirees

- What’s Coming Next

Chapter 4 — Why Medicare Advantage Critics Get It Wrong

The data behind the debate

- Why We Need to Address the Negative Narratives

- The Prior Authorization Reality: Numbers Don’t Lie

- The Network “Limitation” Myth: Choice Is Actually Expanding

- Quality Measures: Medicare Advantage Outperforms Original Medicare

- Financial Reality: Medicare Advantage Saves Money

- The Care Coordination Advantage Critics Can’t Explain Away

- Special Populations: Where Medicare Advantage Excels

- Market Competition: Driving Continuous Improvement

- Who’s Really Behind the Anti-Medicare Advantage Campaign

- The Congressional Budget Office Reality Check

- What the Critics Can’t Explain

- The 2026 Regulatory Improvements

- Key Takeaways

- The Bottom Line

- What’s Coming Next

Chapter 5 — How Veterans Can Avoid Overpaying for Medicare Part B

Keeping more money in your Social Security check every single month

- How Veterans Access the Lowest Possible Part B Premium

- Why Veterans Are Well-Positioned for the Lowest Part B Premiums

- The Current Market Reality for 2025

- The Financial Impact Over Your Retirement

- How to Access the Lowest Part B Premium Available

- Why Independent Veteran-Focused Specialists Matter

- Common Misconceptions That Cost Veterans Money

- Strategic Considerations for Different Types of Veterans

- Key Takeaways for Veterans

- What’s Coming Next

Chapter 6 — Avoiding Medicare Penalties

How to keep your hard-earned dollars instead of paying Uncle Sam for life

- Why Medicare Penalties Exist (And Why They’re So Brutal)

- The Part B Penalty: Simple Math, Devastating Results

- The Dangerous Myth: “VA Coverage Protects Me”

- TRICARE for Life: The Double Penalty Trap

- Your Personal Penalty Timeline: Critical Dates Every Veteran Must Know

- The Specialist Difference in Penalty Prevention

- How to Appeal a Medicare Penalty (When the System Makes Mistakes)

- The Part D Penalty (Different Rules for Veterans)

- IRMAA: The Additional Surcharge That Catches Veterans Off Guard

- State Programs That Can Help with Penalties

- Key Takeaways for Veterans

- What’s Coming Next

Chapter 7 — The Costliest Mistakes Veterans Make

Fix these now so you’re not paying for them the rest of your life

- Why “Generic” Medicare Advice Fails Veterans

- Mistake #1 — Buying Unnecessary Medigap Coverage with TRICARE for Life

- Mistake #2 — Ignoring IRMAA Planning and Appeals

- Mistake #3 — Avoiding Medicare Advantage (Part C) Due to Misconceptions

- Mistake #4 — Delaying Medicare While Relying Solely on VA Care

- Mistake #5 — Not Reviewing Plans Annually During Open Enrollment

- Mistake #6 — Poor Record-Keeping and Claims Management

- The Financial Impact of Making Smart Choices vs. Costly Mistakes

- Warning Signs You Need Veteran-Specialized Guidance

- Key Takeaways for Veterans

- What’s Coming Next

Chapter 8 — How to Enroll and Get the Most Benefits

A step-by-step field manual for maximizing your veteran advantages

- Your Pre-Enrollment Battle Plan

- Your Personal Enrollment Timeline

- Step-by-Step Medicare Enrollment Process

- Finding the Right Medicare Advantage (Part C) options for Veterans

- Why Veteran Medicare Specialists Make the Difference at Enrollment

- Introducing Veterans Advantage Financial™: Your Veteran Medicare Specialists

- How to Get Started: Your Next Steps

- Common Questions About Working with Veteran Medicare Specialists

- Key Takeaways for Veterans

- What’s Coming Next

- Your Medicare Mission Starts Now

Chapter 9 — Maximizing Your Medicare Investment

Getting maximum value from what you’ve already paid for

- Why Veterans Need a Different Financial Planning Approach

- The Total Cost Reality: What Veterans Actually Pay

- Understanding Your Healthcare Cost Advantages in Four Steps

- The Hidden Drains on Veterans’ Fixed Income

- Understanding Different Veteran Categories and Their Medicare Advantages

- The Medicare Specialist Advantage

- Key Takeaways for Veteran Financial Planning

- What’s Coming Next

Chapter 10 — Real-World Veteran Success Stories

Proof that the strategies in this field guide pay off, both in dollars and peace of mind

- Why These Stories Matter

- Success Story #1: From VA-Only to Strategic Coordination

- Success Story #2: TRICARE for Life Optimization

- Success Story #3: IRMAA Appeal Success

- Success Story #4: Rural Veteran Gains Local Access

- Success Story #5: Widow Maximizes Survivor Benefits

- The Clear Pattern

- Key Takeaways from These Success Stories

- What’s Coming Next

Chapter 11 — Conclusion & Your Next Steps

Your service earned these benefits. Now it’s time to maximize them.

- Mission Recap: What You’ve Accomplished

- Your Action Plan: 7 Essential Steps

- Veterans Advantage Financial™: Your Implementation Partner

- Your Decision Point

Appendix — Resources & Quick-Reference Toolkit

Everything you need, all in one place

- Essential Contact Information

- Government Agencies & Official Resources

- 2025 Medicare Costs & Key Numbers

- Medicare Enrollment Periods

- Quick Reference Checklists

- Important Medicare Forms

- Emergency Medicare Situations

- State-Specific Assistance Programs

- Veterans-Specific Resources

- Planning Worksheets

- Final Reminders

Introduction

You’ve navigated complex military systems throughout your career. You understand regulations, procedures, and the importance of getting things right the first time. But Medicare feels different, and for good reason: the stakes are your healthcare and financial security for the rest of your life.

The frustration multiplies when everyone seems to have different advice. The person at the VA tells you one thing. Your buddy at the VFW swears by something completely different. Even well-meaning doctors at the VA give out bad advice because they are doctors, not experts with Medicare. Meanwhile, the clock is ticking on enrollment deadlines, and the specter of lifetime penalties hangs over your head.

Miss a critical step, and you could face Medicare Part B late enrollment penalties that increase your premiums by 10% for each 12-month period you were eligible but didn’t enroll. These penalties last for as long as you have Medicare Part B (Source: Medicare.gov, https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties). You could also miss opportunities to keep your Part B premiums as low as possible through Medicare options from private companies that we regularly help veterans access. These options also provide additional benefits that VA, Medicare, and TRICARE for Life don’t offer. My dad Wallace Duncan, an 82-year-old Vietnam-era veteran, ensures he’s not overpaying for Part B through his Medicare option, and our clients consistently avoid overpaying for their Part B coverage while accessing these additional benefits.

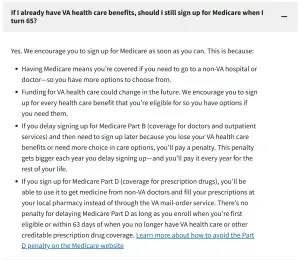

Even the VA itself encourages veterans to sign up for Medicare, warning that “funding for VA health care could change in the future” and emphasizing the need for backup coverage options (Source: VA.gov, https://www.va.gov/health-care/about-va-health-benefits/va-health-care-and-other-insurance/).

The Problem with “One-Size-Fits-All” Medicare Advice

Most Medicare advisors have never worked exclusively with veterans, and that creates a dangerous knowledge gap. They don’t understand when Medicare works alongside military benefits and when it doesn’t. For example, VA healthcare doesn’t count as creditable coverage for Medicare Part B, which means delaying Medicare Part B enrollment while relying only on VA benefits can result in lifetime penalties (Source: VA.gov, https://www.va.gov/health-care/about-va-health-benefits/va-health-care-and-other-insurance/). These advisors also don’t understand VA priority groups, TRICARE integration, or service-connected disabilities.

Consider the parallel. You wouldn’t ask a Navy SEAL to plan an Air Force mission, just like you wouldn’t ask an Air Force strategist to lead underwater demolition. Both are elite military professionals, but their expertise is mission-specific. So why would you go to a Medicare advisor who doesn’t specialize in veteran issues when you need someone who understands your unique situation?

Who I Am and Why I Wrote This Field Guide

I’m Christopher Duncan, a Certified Medicare Insurance Planner™ and Retirement Income Certified Professional® with nearly 20 years of Medicare experience. Our specialists work exclusively with veterans, which is why I trademarked the phrase We Speak Veteran™. This isn’t just marketing; it’s the foundation of everything we do. While other Medicare advisors try to serve everyone, we’ve spent years learning exactly how Medicare works alongside VA benefits, TRICARE for Life, and the unique situations veterans face.

Our Promise to Every Veteran

Here’s something we’ve never put in writing before, but it guides every recommendation we make. We treat each veteran as if they were our own parents. We don’t make any recommendations that we wouldn’t put our own parents in if they lived in your ZIP code.

This isn’t just a business philosophy. It’s personal. My dad Wallace is one of our clients. Richard Fochtman, one of my best friends and a 100% disabled Vietnam veteran (read more about him in the acknowledgments), trusts us with his Medicare decisions too. Along with thousands of veterans, they rely on us because they know one thing. Every day, we apply the same standards to your Medicare decisions that we use for the people closest to me. When Jeff, Dana, and I analyze options, we ask ourselves one question: “Would we recommend this to our own family?”

This commitment runs deep because we’ve all experienced the weight of these healthcare decisions with people we love. We’ve seen what happens when Medicare advice goes wrong, and we’ve witnessed the relief that comes from getting it right. That’s why we sometimes tell veterans things they don’t want to hear. If an option isn’t right for you, we’ll say so, even if it means losing a potential enrollment. If Original Medicare makes more sense for your specific situation, that’s what we’ll recommend. Your trust matters more than any single transaction.

This confusion you’re experiencing, this overwhelming sense of “I should know this, but I don’t,” is exactly why I felt compelled to write this field guide. Over the years, we have guided thousands of veterans through Medicare decisions, and I’ve seen the same dangerous misconceptions repeated over and over again.

I’ve watched accomplished veterans delay Medicare enrollment, thinking their VA coverage was enough, only to get hit with lifetime penalties that cost them tens of thousands of dollars. I’ve seen military retirees unknowingly cancel their TRICARE for Life benefits because they didn’t understand Medicare’s requirements. And I’ve met countless veterans who had never heard that Medicare options from private companies can help keep Part B premiums as low as possible, offer additional benefits that VA, Medicare, and TRICARE for Life don’t provide, and have monthly premiums as low as $0, all because their advisor never mentioned these opportunities existed.

Take my dad, Wallace Duncan. At 82 years old, this Vietnam-era veteran ensures he’s not overpaying for Part B through his Medicare option from a private company while accessing additional benefits. Without proper guidance, he would be overpaying for his Part B coverage. These opportunities exist across the Medicare marketplace, with nearly one-third (32%) of Medicare options from private companies now offering ways to minimize Part B costs in 2025 (Source: KFF.org, https://www.kff.org/medicare/issue-brief/medicare-advantage-2025-spotlight-a-first-look-at-plan-premiums-and-benefits/).

One thing became crystal clear to me through all these experiences. These weren’t careless mistakes. These are patriots who served their country with honor and dedication. They deserve better than confusing government jargon, complicated regulations, and advice from professionals who don’t understand their unique situation.

Why Independence Matters

There’s another crucial difference between our approach and what you’ll find elsewhere. My team and I are completely independent. We don’t work for the VA, Medicare, or any specific insurance company. We’re not bound by corporate quotas or pressured to recommend particular options.

This independence gives us the freedom to do one thing: find the absolute best Medicare solution for each veteran’s unique situation. Whether that’s identifying Medicare options from private companies that help you avoid overpaying for Part B, ensuring Medicare works alongside existing TRICARE or VA healthcare coverage (Source: VA.gov, https://www.va.gov/health-care/about-va-health-benefits/va-health-care-and-other-insurance/), or ensuring Medicare fills gaps left by your military benefits, our only loyalty is to each veteran we serve.

What You’ll Find in This Guide

I’m going to give you straight answers and actionable information. We do help veterans navigate Medicare, but whether you work with us or not, this guide provides the knowledge to help you avoid costly mistakes and maximize your benefits.

You should also know that Medicare rules are structured so that we can provide all of our services completely free to veterans while still making a living helping veterans navigate these complex decisions. This means there’s never any cost to you for our guidance, reviews, or ongoing support. You pay exactly the same for your Medicare coverage whether you work with us or go directly to the insurance companies. The difference is you get expert veteran-focused guidance at no additional cost.

Whether you’re planning to rely mainly on VA care, you have TRICARE for Life, or you’re helping a family member navigate these decisions, this field guide covers:

- Battle-tested strategies for integrating VA, TRICARE, and Medicare into one powerful healthcare system

- Proven methods used by thousands of veterans to avoid lifetime penalties

- Clear instructions for finding Medicare options that keep your Part B premiums as low as possible

- Key differences between cookie-cutter advice and veteran-specialized guidance

- Essential information for making Medicare decisions that protect both your health and your finances

Who This Field Guide Is For

I wrote this specifically for:

- Veterans who use VA healthcare and want a solid backup plan for civilian medical care

- Military retirees with TRICARE for Life who need to maintain Medicare to keep this valuable benefit

- Spouses, caregivers, and family members who help veterans make important healthcare decisions

- Any veteran who’s tired of getting standard Medicare advice that ignores their military benefits

If any of these descriptions fit you, then you’re exactly who I had in mind. Your hard-earned benefits are on the line, and this field guide will give you the knowledge and tools to understand, protect, and maximize them.

Now let me explain what sets this guide apart from the generic Medicare resources you’ve probably already encountered.

What Makes This Different

This isn’t another Medicare guide with a veteran logo slapped on the cover. Every strategy, every example, and every piece of advice in this field guide has been tested with real veterans facing real Medicare decisions. The case studies you’ll read aren’t hypothetical. They’re based on typical situations my team and I encounter regularly.

You’ll learn not just what to do, but why it works specifically for veterans. You’ll understand how to use your military benefits with Medicare to create coverage that’s often better and usually less expensive than what civilian retirees can access.

Most importantly, you’ll discover veteran-specific opportunities that most Medicare advisors never mention because they don’t specialize in military benefits.

Ready to Take Control?

Let’s get started.

Questions about how Medicare works alongside your VA healthcare, TRICARE for Life, or service-connected benefits? My team and I help veterans navigate these complex decisions every day. Call us at 888-960-8387 (VETS) for personalized guidance, or find educational content on our social media channels. Experience what WE SPEAK VETERAN™ really means.

Chapter 1 — Medicare Basics for Veterans

Everything you need to know to get started

1. Medicare at a Glance—What It Really Means for Veterans

Let’s start with the basics, but from a veteran’s perspective. You’ve navigated complex military systems throughout your career. Medicare should be no different once you understand how it works specifically for veterans.

Medicare is the federal health insurance program for Americans age 65 and older, plus some younger people with specific disabilities. But most generic Medicare guides won’t tell you that for veterans, Medicare isn’t just another insurance option. It’s often the keystone that holds your entire healthcare strategy together.

When you enroll in Medicare, it generally becomes the primary payer for medical services you receive outside the VA system. This means Medicare pays first, and other coverage like TRICARE for Life kicks in afterward (Source: TRICARE.mil, https://tricare.mil/Plans/HealthPlans/TFL). If you only have VA health benefits and no Medicare coverage, you cannot receive care outside the VA system unless the VA pre-authorizes it through their Community Care program, and they can deny those requests.

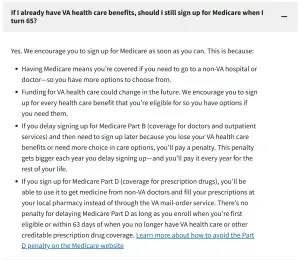

The VA itself encourages you to sign up for Medicare as backup coverage. In fact, the VA explicitly states on their website:

As you can see, the VA explicitly states they encourage veterans to sign up for Medicare because “Funding for VA health care could change in the future” and having Medicare means “you’re covered if you need to go to a non-VA hospital or doctor—so you have more options to choose from” (Source: VA.gov, https://www.va.gov/health-care/about-va-health-benefits/va-health-care-and-other-insurance/).

If you’re a military retiree, Medicare Parts A and B aren’t optional. They’re mandatory for keeping your TRICARE for Life benefits.

Think of it this way: Medicare is like the foundation of a house. Your VA benefits, TRICARE for Life, and other military health benefits are the rooms built on top of that foundation. Without a solid Medicare foundation, the whole structure becomes unstable.

Now, if you’re like my dad and use the VA for 95% of your health services, you might think of the VA as your primary foundation. But Medicare is still that critical backup structure, ready when the VA falls short. On more than one occasion, the VA has denied my father coverage. He didn’t panic because he had Medicare as his backup plan.

This layered approach isn’t just smart. It’s required. Why does this matter so much? Because life happens. Sometimes the closest VA facility is hours away. Maybe you need to see a specialist who’s not available through the VA, and the VA denies your Community Care referral.

Veterans must meet strict eligibility requirements for Community Care, including specific drive time and wait time standards, and the VA can deny requests that don’t meet their criteria. If your request is denied, you can appeal through the VA’s Clinical Appeals process, but that takes time you might not have when you need medical care (Source: VA.gov, https://www.va.gov/resources/eligibility-for-community-care-outside-va/). With Medicare as your backup, you have immediate access to civilian specialists without waiting for VA approval or appeals.

Perhaps you’re traveling and a medical emergency strikes. While the VA encourages veterans to seek immediate care without delay, they can only cover the cost of your emergency care if you meet specific requirements: you must be enrolled in VA healthcare, a VA facility wasn’t “feasibly available,” you must notify the VA within 72 hours of when your emergency care starts, and you must meet other situation-specific requirements (Source: VA.gov, https://www.va.gov/resources/getting-emergency-care-at-non-va-facilities/). Miss any of these criteria, and you could be stuck with the entire emergency room bill.

Just like you wouldn’t deploy with only one piece of critical equipment, you shouldn’t navigate retirement healthcare with only one coverage option. You’ve earned VA benefits through your military service AND you’ve paid into Medicare through FICA taxes your entire working life. Why would you rely on just one when you’ve rightfully earned access to both? Smart veterans layer their benefits strategically, creating multiple lines of defense for their healthcare needs.

2. The Four Parts: Decoded for Veterans

Medicare has different parts, and yes, it can seem complicated at first. After nearly two decades in the Medicare industry and helping thousands of veterans navigate these decisions, I can tell you that once you understand how each part works with your existing military benefits, it starts to make sense. Let me break it down in plain English:

Part A: Hospital Insurance

What it covers: Hospital stays, skilled nursing facilities, some home health care, hospice care

2025 cost: $0 for most veterans (you already paid through payroll taxes during your career)

Why veterans need it:

- Keeps TRICARE for Life active for military retirees

- Covers hospital stays anywhere Medicare is accepted

- Required foundation for all other Medicare benefits

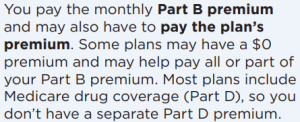

Part B: Medical Insurance

What it covers: Doctor visits, outpatient services, preventive care, durable medical equipment, emergency room visits, diagnostic tests, and most medically necessary services outside of hospital stays (Source: CMS.gov, https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles)

2025 cost: $185/month standard premium (higher if you have high income due to IRMAA surcharges, which affect about 8% of Medicare beneficiaries) (Source: Veterans Advantage Financial, https://veteransadvantagefinancial.vet/irmaa/)

Why veterans need it:

- Required for TRICARE for Life: we see veterans lose their TRICARE for Life benefits when they don’t maintain Part B enrollment (Source: TRICARE.mil, https://tricare.mil/Plans/Eligibility/MedicareEligible)

- Required for any Medicare Advantage (Part C)

- Backbone of outpatient care nationwide

- Emergency room coverage anywhere in the US, even at facilities that don’t accept Medicare

- Enables access to options that keep Part B premiums as low as possible

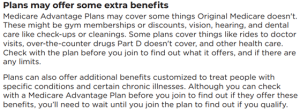

Part C: Medicare Advantage

What it covers: Must at least provide every benefit that Part A and B cover, often with additional benefits that VA, Medicare, and TRICARE for Life don’t provide. Medicare states that “Medicare Advantage Plans must cover all of the services that Original Medicare covers” (Source: Medicare.gov, https://www.medicare.gov/basics/get-started-with-medicare/using-medicare/how-to-get-medicare-services)

Average $17/month for Medicare options from private companies, with 75% having no monthly premium. Keep reading to see why they have no monthly premium.

Why veterans need it:

- Allows continued use of VA and TRICARE benefits

- Many options help veterans avoid overpaying for Part B, with nearly one-third (32%) of Medicare options from private companies offering ways to minimize Part B costs in 2025 (Source: KFF.org, https://www.kff.org/medicare/issue-brief/medicare-advantage-2025-spotlight-a-first-look-at-plan-premiums-and-benefits/)

- Additional benefits that VA, Medicare, and TRICARE for Life don’t provide

- Can enhance military benefits, something my team and I specialize in helping veterans achieve

- Emergency room coverage anywhere in the US at any facility. Medicare Advantage plans must cover emergency and urgent care nationwide as in-network services, even if the facility isn’t in the plan’s network. Some Medicare Advantage plans may also include worldwide emergency coverage (Source: AARP, https://www.aarp.org/health/medicare-insurance/info-2024/medicare-coverage-on-vacation.html).

Part D: Prescription Drug Coverage

What it covers: Prescription medications (if not included in Part C)

2025 cost: Average $35-55/month for standalone plans

Why veterans should carefully evaluate Part D:

- VA prescription coverage is “creditable,” meaning there’s no penalty for delaying Medicare Part D as long as you enroll when first eligible or within 63 days of when you no longer have VA health care or other creditable prescription drug coverage (Source: KFF.org, https://www.kff.org/faqs/medicare-open-enrollment-faqs/i-have-drug-coverage-from-the-va-do-i-need-to-sign-up-for-a-part-d-plan/)

- TRICARE for Life includes prescription benefits

- Many Medicare options from private companies include drug coverage at no additional premium

Most veterans already have creditable prescription drug coverage through VA or TRICARE for Life, which protects them from Part D penalties. However, you should evaluate whether Part D might provide better coverage, lower costs, or access to medications not covered by your military benefits. Remember, having multiple prescription options gives you flexibility when the VA formulary doesn’t include a medication you need or when filling prescriptions while traveling.

3. Where the Money Comes From: You’ve Already Paid Your Dues

Something that might surprise you: Remember those old pay stubs from your military service and civilian career? There was a line item called “FICA”, the Federal Insurance Contributions Act tax that funds Social Security and Medicare. During my extensive time in the industry, I’ve seen thousands of veterans who don’t realize they’ve already paid for these benefits.

Think about it this way: if you earned around $50,000 a year over a 40-year career, you and your employers contributed about $58,000 toward Medicare through those FICA taxes on your pay stub at the current rate of 2.9% (Source: IRS.gov, https://www.irs.gov/taxtopics/tc751). If you averaged more than $50,000 per year, then a higher amount has been paid into Medicare by you and your employers. So when we talk about Medicare benefits, you’re not getting something “free.” You’re collecting on an investment you’ve been making your entire working life.

Many veterans we work with make a costly mistake. They skip Medicare Part B with the thought, “I have VA benefits, and that’s enough.” What they’re really saying is they don’t want to pay the Part B premium, and I don’t blame them for that concern.

This changes how you should think about Medicare costs: there are now Medicare options from private companies with premiums as low as $0 that help keep your Part B costs as low as possible.

Not enrolling in Part B is like walking away from decades of your own contributions to Medicare. You’ve already paid into the system your entire working life. Why would you walk away from benefits you’ve already paid for?

The bigger picture changes how you should think about Medicare costs. Those Medicare options from private companies with premiums as low as $0 aren’t really free. They’re funded partly by the taxes you already paid over decades of work. And when an option helps you avoid overpaying for Part B, you’re keeping more of what’s rightfully yours based on decades of FICA contributions.

My dad, Wallace Duncan, an 82-year-old Vietnam-era veteran, understands this perfectly. Through his Medicare option from a private company, he obtains the lowest possible Part B premium while maximizing additional benefits. This isn’t charity from an insurance company. It’s making the most of the investment he’s made through decades of payroll taxes. We help veterans access similar strategies to avoid overpaying for their Part B coverage.

4. Three Critical Reasons Veterans Cannot Ignore Medicare

Throughout my Medicare career, I’ve discovered unique challenges veterans face that most advisors never understand. I’ve seen what happens when veterans ignore Medicare thinking their military benefits are enough. Let me share the three most critical reasons my team and I tell every veteran they absolutely cannot afford to ignore Medicare.

Reason #1: VA Funding and Eligibility Can Change

The VA budget is set by Congress every year, and recent events prove how unpredictable this can be. In 2024, VA faced a $6.6 billion budget shortfall that required emergency congressional action to prevent service cuts (Source: Federal News Network, https://federalnewsnetwork.com/budget/2024/11/va-updates-fy-2025-health-care-budget-shortfall-to-6-6b-nearly-half-its-previous-estimate/).

We have worked with veterans who suddenly faced reduced VA services due to budget constraints they had no control over. Funding levels, eligibility criteria, and covered services can shift based on political decisions that have nothing to do with your needs. Your VA care might be affected by factors completely outside your control.

Medicare, however, is a federal entitlement. I hate the word entitlement because it implies something given rather than earned, when you’ve actually paid into Medicare your entire working life through FICA taxes. You’ve earned and paid for these benefits your entire working life. Once you’re enrolled, your coverage is guaranteed by law. It’s security you control, not politicians.

Reason #2: Emergency Freedom Nationwide

In a medical emergency, any hospital must treat you, even if it’s not a VA facility. But the catch is that the VA might not cover the bills if they determine it wasn’t an approved emergency or if you could have reasonably reached a VA facility.

Original Medicare and Medicare Advantage (Part C) provide universal emergency coverage at any hospital in the United States. I’ve worked with veterans who were vacationing in Florida when they had to go to the emergency room, 200 miles from the nearest VA facility. Their Medicare coverage meant immediate treatment without worrying about VA approval or massive bills. That’s the kind of protection every veteran needs, especially if you travel or live far from VA care.

Reason #3: TRICARE for Life Depends on It

If you’re a military retiree with TRICARE for Life, listen carefully: TRICARE for Life requires you to have both Medicare Part A and Part B. Skip Part B, and you lose TRICARE for Life entirely. This isn’t optional. Federal law (10 U.S.C. § 1075) specifically requires both Medicare Parts A and B to maintain TRICARE for Life eligibility (Source: TRICARE.mil, https://tricare.mil/Plans/Eligibility/MedicareEligible).

I’ve worked with military retirees who lost their TRICARE for Life benefits because they tried to skip Part B to save money. Once you lose TFL, getting it back requires enrolling in Medicare and potentially facing late enrollment penalties for the rest of your life.

Enrolling in Medicare on time ensures you keep this valuable benefit that acts as outstanding secondary coverage, eliminating virtually all out-of-pocket costs for covered medical services. When we work with career military veterans who have TRICARE for Life, we call it the ‘golden ticket’ of medical coverage. But that golden ticket only works if you maintain at least Medicare Parts A and B. Skip either one, and you lose this incredible benefit that you’ve earned through 20+ years of service.

Understanding these critical reasons is important, but it’s equally important to understand why generic Medicare advice consistently fails veterans.

5. Where Generic Medicare Advice Falls Short for Veterans

My team and I have cleaned up countless messes created by generic Medicare advisors who treat every 65-year-old the same way. The standard advice they give veterans is the exact same advice they give everyone else:

- “Just get a Medicare Supplement plan to cover the gaps”

- “Medicare Advantage plans limit your doctor choices”

- “You should always enroll in Part D to avoid penalties”

- “Original Medicare is always better than Medicare Advantage”

For civilian retirees, this one-size-fits-all approach might work. But veterans aren’t civilian retirees. Veterans have earned unique benefits through their service, and these benefits fundamentally change what makes sense for Medicare coverage.

The Veterans-Specific Questions Generic Advisors Never Ask

When we work with veterans, we start with questions that generic advisors never think to ask:

- Do you have TRICARE for Life?

- What’s your VA priority group?

- Do you use VA Community Care?

- How far do you live from VA facilities?

- What percentage of your care comes from the VA versus civilian providers?

These critical factors determine your optimal Medicare strategy. Generic advisors who don’t understand military benefits consistently provide advice that costs veterans thousands while missing valuable opportunities they’ve earned through their service.

Real-World Example: The Cookie-Cutter Failure

A career Air Force veteran contacted us after working with a generic Medicare advisor who recommended Original Medicare plus a $189 monthly Medigap Plan G because “it’s the gold standard.” The advisor never asked about military benefits or considered veteran-specific alternatives.

The generic advisor missed several critical points:

- The veteran had TRICARE for Life, making Medigap completely unnecessary

- A Medicare option from a private company in his area helped keep his Part B premium as low as possible

- The same option included additional benefits that VA, Medicare, and TFL don’t provide

- He could have been paying far less monthly while gaining additional benefits

The cost of generic advice: $3,948 annually in missed opportunities.

The Independence Advantage

We are completely independent. We don’t work for any insurance company or receive bonuses for recommending specific plans. When generic advisors tied to specific companies tell you “this is the best plan available,” they’re really saying “this is the best plan my company offers.”

We can evaluate every plan available in your area to find the one that actually maximizes your veteran benefits. This independence means we can recommend any solution that’s right for you, whether that’s Original Medicare, Medigap, or Medicare Advantage, without being restricted to specific companies or plan types.

What Makes Veteran-Specific Expertise Different

As specialists who work exclusively with veterans, we understand how Medicare works alongside your existing military benefits to create comprehensive coverage. We analyze how Medicare works alongside VA priority groups, TRICARE for Life requirements, and service-connected disability considerations.

Our expertise means recognizing that veterans with TRICARE for Life already have coverage that functions better than any Medicare Supplement plan, eliminating virtually all out-of-pocket costs. We understand that veterans often prefer specific provider networks through established VA relationships or TRICARE providers, making Medicare Advantage PPO plans particularly valuable for maintaining continuity of care while adding flexibility.

We evaluate prescription drug options knowing that TRICARE for Life includes robust pharmacy benefits through Express Scripts, while also understanding when Medicare Part D might provide access to medications not on the VA formulary or offer more convenient pharmacy options during travel. This complete understanding allows us to develop strategies that maximize every benefit you’ve earned through military service.

Now that you understand the basics, let me share the costly mistakes I see veterans make when they get generic Medicare advice instead of veteran-specific guidance.

6. Common Mistakes Veterans Make (And How Specialists Help You Avoid Them)

Working exclusively with veterans has shown me the same costly mistakes happen over and over when veterans rely on generic Medicare advice. Here are the four biggest missteps that cost veterans thousands:

Mistake #1: Waiting Past 65 to Enroll in Part B

Many veterans think, ‘The VA covers me, I’ll sign up later.’ This is one of the most expensive mistakes you can make. For every 12-month period you delay Part B after your Initial Enrollment Period, you face a lifelong 10% penalty on your Part B premium.

Wait just two years and you’ll pay an extra $37 monthly ($444 annually) based on today’s premium, but the kicker is that as Part B premiums increase every year, your penalty grows too because it’s a percentage of the current premium, not a fixed dollar amount. Over 20 years, that 20% penalty could easily cost you $10,000 or more (Source: Medicare.gov, https://www.medicare.gov/basics/costs/medicare-costs/avoid-penalties).

On a regular basis we have veterans that call us at age 70, 75 wanting to put their Part B in place, because the VA health system isn’t meeting all their needs. As my dad Wallace says, “Chris, the VA health system is great, but it ain’t perfect.” When veterans realize the VA can’t meet all their needs and try to add Part B, they discover they face both waiting periods and lifetime penalties.

They contact Social Security to try and put their Part B in place only to learn they have to wait for the general enrollment period that goes from January 1 to March 31, but the big shock is the Part B premium penalty they have to pay every month for the rest of their life.

On a regular basis, veterans tell us about the conflicting advice they received before calling us. A VA representative assured them their VA coverage would protect against Part B penalties. Their doctor at the VA told them they didn’t need Part B. In some cases, even a Social Security representative suggested they skip Medicare to save money since they have VA coverage.

While these professionals mean well, they often aren’t aware that Medicare options from private companies can help veterans keep their Part B premiums as low as possible, making coverage more affordable than they realize.

Veteran Medicare specialist insight: VA coverage is not creditable coverage for Medicare Part B penalty purposes. According to Medicare.gov, only employer group health plan coverage allows you to delay Part B enrollment without penalties, and VA coverage does not qualify (Source: Medicare.gov, https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/working-past-65).

Mistake #2: Thinking TRICARE for Life Replaces Medicare

TRICARE for Life doesn’t replace Medicare. It works alongside Medicare as wraparound coverage, also called secondary coverage. Without at least Medicare Parts A and B, TRICARE for Life simply doesn’t function. TRICARE for Life also provides wraparound coverage for Medicare Part C (Medicare Advantage).

Veteran Medicare specialist insight: Medicare (Parts A, B, or C) pays first, TFL covers what’s left, giving you virtually zero out-of-pocket costs.

Mistake #3: Dismissing Medicare Advantage (Part C) Plans

Some veterans think Medicare Advantage is only for civilians or that it will interfere with their VA benefits. This misconception costs them thousands in missed benefits.

Veteran Medicare specialist insight: Many Medicare options from private companies work well for those with VA benefits and/or TRICARE for Life. They don’t interfere with your military benefits. They enhance them with additional benefits that VA, Medicare, and TFL don’t provide while helping you avoid overpaying for Part B.

Mistake #4: Believing TRICARE for Life Won’t Work with Medicare Advantage (Part C)

This might be the most damaging misconception of all. Many veterans are told by TRICARE representatives, VA staff, or even generic Medicare advisors that “TRICARE for Life doesn’t work with Medicare Advantage plans” or that “you’ll lose your TRICARE benefits if you choose Part C.” This is completely false and costs veterans thousands in missed benefits.

According to the official TRICARE website, “If you enroll in a Medicare Advantage Plan, you still have Medicare. Medicare is still your primary coverage, and TRICARE For Life is the second payer for TRICARE-covered services” (Source: TRICARE.mil, https://tricare.mil/FAQs/TRICARE-with-Medicare/TRIMed_Advantage).

The only difference is that Medicare Advantage claims don’t automatically crossover to TRICARE, so you may need to file claims manually for TRICARE-covered services.

Real-world veteran Medicare specialists have an advantage over generalists. Specialists understand how the system actually works in practice, not just what’s written in a manual. Medical providers run businesses, and as they serve more Medicare-eligible patients, they’ve learned how to streamline billing for maximum reimbursement.

Most providers who work with TRICARE beneficiaries already know how to bill TRICARE for Life directly through Wisconsin Physician Services (WPS), which administers TFL. We haven’t had a client need manual claim forms in over two years because providers have streamlined their processes for Medicare beneficiaries and understand how to bill WPS for the TFL portion of the bill.

Veteran Medicare specialist insight: Many Medicare options from private companies offer significant benefits that veterans miss out on because of this misconception. These include ways to minimize Part B premiums and add additional benefits that VA, Medicare, and TRICARE for Life don’t provide. TRICARE for Life provides wraparound coverage for both Original Medicare and Medicare Advantage plans from private companies that contract with Medicare, allowing veterans to access these additional benefits while maintaining comprehensive coverage.

7. The Power of Veteran-Focused Guidance

When my team and I work with veterans, we don’t start with generic Medicare questions. We start with questions like:

- Do you have TRICARE Prime or Select? (if under 65)

- Do you have a spouse or children on your TRICARE Prime or Select?

- Do you have TRICARE for Life?

- What’s your VA priority group?

- Do you use Community Care?

- Do you have any level of disability?

- How far do you live from VA facilities?

- Do you get your prescription from a VA facility?

- If so, do you get them directly at a VA facility or through mail order?

- What percentage of your care do you get through the VA versus civilian providers?

- Do you travel frequently or spend time in multiple states?

These aren’t questions that generic Medicare advisors even know to ask, but they’re absolutely crucial for developing the right strategy for your situation. For example, a veteran who’s 100% service-connected and lives next to a VA medical center needs a completely different Medicare strategy than a veteran with 20% disability who uses VA care occasionally and travels frequently between states.

What really frustrates me is that I regularly see veterans who were told by generic advisors that “VA coverage means you don’t need Medicare” or “just get Original Medicare with a Supplement plan like everyone else.”

These advisors don’t understand that VA coverage provides no protection from Medicare Part B penalties, or that military retirees with TRICARE for Life are wasting thousands annually on unnecessary Medigap policies. They treat veterans like any other Medicare enrollee instead of recognizing the unique integration opportunities and financial benefits that military service has earned.

Veterans who work with specialists consistently end up with better outcomes including lower out-of-pocket costs, more comprehensive coverage, and Medicare strategies that enhance their military benefits instead of competing with them.

This is exactly what We Speak Veteran™ means in practice. We don’t just understand Medicare. We understand how your specific military situation changes everything about what makes sense for your Medicare strategy. We speak your language because we specialize exclusively in veterans, not because we slapped a military logo on generic Medicare advice.

8. Key Takeaways for Veterans

Let me recap the essential points every veteran needs to understand:

✓ Medicare is your nationwide safety net that works alongside (not instead of) your VA benefits and keeps TRICARE for Life active

✓ Part A is usually premium-free, Part B costs $185/month in 2025 and missing Part B enrollment can lead to costly lifetime penalties, according to the Centers for Medicare & Medicaid Services (Source: CMS.gov, https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles)

✓ Medicare Advantage (Part C) doesn’t cancel your VA or TRICARE benefits. It can enhance them while minimizing your Part B premiums

✓ You’ve already earned these benefits through decades of FICA taxes from military service and civilian work: you’re not asking for handouts, you’re collecting on an investment you’ve already made

✓ Generic Medicare advice consistently fails veterans: you need guidance from specialists who understand how military benefits change everything about your Medicare strategy

✓ The right strategy integrates all your benefits to create coverage that’s often better and less expensive than what civilian retirees can access

✓ TRICARE for Life and Medicare Advantage (Part C) work together effectively: Medicare Advantage pays first, then TRICARE for Life covers most or all of your remaining costs, often leaving you with zero out-of-pocket expenses

These aren’t just facts to memorize. They’re the foundation of a Medicare strategy that protects everything you’ve earned through your service.

9. What’s Coming Next

Now that you understand Medicare basics from a veteran’s perspective, Chapter 2 will dive into a crucial question: How exactly do VA health benefits and Medicare complement each other? Can they coexist without creating conflicts?

The answer is yes, and when integrated properly by someone who understands both systems, they create a powerful combination that gives you the best of both worlds.

I’ll show you how smart veterans use both systems strategically, the specific situations where Medicare fills critical gaps in VA coverage, including emergency care away from the VA and access to specialists when the VA can’t provide them quickly enough.

Most importantly, I’ll help you avoid the costly mistakes that generic Medicare advisors regularly make with veterans: mistakes that can cost you money every single month for the rest of your life.

Questions about how Medicare works with your specific VA or TRICARE benefits? My team and I help veterans navigate these decisions every day. Call us at 888-960-8387 (VETS) for personalized guidance that demonstrates what WE SPEAK VETERAN™ really means.

Chapter 2 — VA Health Benefits vs. Medicare

Why relying on the VA alone can leave dangerous gaps

1. Let’s Talk About How VA Health Care Really Works

Before we dive into how Medicare and VA benefits can complement each other, you need to grasp exactly what your VA coverage does and doesn’t provide. Throughout my nearly two decades in Medicare, now working exclusively with veterans, I’ve met thousands who don’t fully recognize their VA benefits. This isn’t their fault. The VA system is complex, and it’s constantly evolving.

VA health care is a tremendous benefit that you’ve gained from military duty. For many veterans, it provides excellent care at incredibly low costs. But you absolutely need to know this. VA health care operates within a very specific framework, and knowing those boundaries could save you from financial disaster.

The Priority Group System: Where You Stand Matters

The VA assigns every veteran to one of eight priority groups. Your priority group determines what you pay for care and, more importantly, whether you can get care at all when VA budgets get tight. Let me explain what this means for you.

Priority Groups 1-6 generally have good protection and access to care. Priority Groups 7-8 (my dad is a priority 8) are vulnerable during budget cuts and may face service reductions or even loss of eligibility. In fact, the Congressional Budget Office has formally proposed ending enrollment for all veterans in Priority Groups 7 and 8, which would disenroll approximately 2 million veterans (Source: Congressional Budget Office, https://www.cbo.gov/budget-options/58671). I’ve worked with veterans who assumed their VA coverage was permanent, only to discover they could lose access if Congress reduces VA funding. Your priority group isn’t just a number, it’s your security level within the VA system. We have had clients that have lost their 100% disability rating or lower disability ratings because they have been “cured” in the VA’s eyes. Under federal regulation 38 CFR 3.327, the VA conducts routine reexaminations every 2-5 years to verify the continued existence or current severity of a disability, and veterans are required to report for such reexaminations (Source: eCFR.gov, https://www.ecfr.gov/current/title-38/chapter-I/part-3/subpart-A/subject-group-ECFR39056aee4e9ff13/section-3.327).

But recognizing your priority group is just the beginning. What really matters is realizing exactly what’s covered and what isn’t, because the gaps might surprise you.

One of the biggest gaps involves emergency care at non-VA hospitals. This is where I see veterans face unexpected bills, and it happens more often than you’d think. The VA has extremely strict rules about when they’ll pay for non-VA emergency care, and their definition of ’emergency’ might not match yours or your doctor’s. The VA requires that a ‘prudent layperson’ would reasonably believe that a delay in seeking care would put your life or health in danger, among several other specific requirements that must be met (Source: VA.gov, https://www.va.gov/resources/getting-emergency-care-at-non-va-facilities/).

Beyond the priority system, there are specific coverage boundaries that affect all veterans, regardless of their priority group. Let me break down exactly what the VA covers and where the gaps exist.

What the VA Actually Covers: The Complete Picture

To help you understand these limitations clearly, see this complete breakdown of VA coverage:

Medical Service | VA Coverage | Your Typical Cost | Critical Limitations |

Service connected conditions | Fully covered | $0 | Only covers the specific condition and related care |

Primary care at VA facilities | Covered based on priority group | $0-$50 copay | Must use assigned facility; limited appointments |

Emergency care at non-VA hospitals | Only if very strict criteria are met | You may owe the entire bill | VA must approve it as “true emergency” |

Specialist care | Available but limited | $0-$50 copay | Not all specialties at all facilities |

Prescriptions through VA | Covered on formulary | $0-$11 per supply | Limited to VA-approved medications |

2. Where Medicare Fits Into Your Healthcare Strategy

The key insight that changes everything is simple. Medicare and the VA are completely separate systems. Different laws, different budgets, different ID cards, different rules, different everything. They don’t communicate with each other, and one absolutely does not pay the other’s bills.

The secret is knowing when to use which system and how Medicare can address what’s missing in VA coverage.

The Basic Rule

- Care inside VA facilities using your VA benefits: Medicare won’t pay anything

- Care outside the VA system: The VA generally won’t pay unless you meet their strict criteria. Note: VA community care programs don’t count as ‘outside the VA system’ since the VA authorizes and pays for this care

- The gap: This is where Medicare becomes your safety net

Recognizing these distinct systems determines when Medicare can save you thousands of dollars in unexpected medical bills.

Medicare’s Universal Acceptance

While VA care is limited to VA facilities and a small network of approved community providers, Medicare is accepted at:

- Nearly every hospital in the United States (over 6,000 facilities)

- More than 900,000 practicing physicians

- Tens of thousands of urgent care centers and specialist practices

- Virtually every major medical center and academic hospital

This means Medicare gives you access to medical care wherever you are in the country, 24/7, without needing to use your assigned VA facility or meet the emergency requirements discussed above.

3. Why Generic Medicare Advisors Miss the Point

Grasping these distinctions is crucial, but it’s equally important to recognize why generic Medicare advisors often miss these nuances.

This is exactly where working with veteran specialists becomes crucial. A typical Medicare advisor might tell a veteran: “You have VA coverage, so you probably don’t need much Medicare.” Or they might say, “Just get Original Medicare and a Supplement plan. That covers everything.”

But veteran Medicare specialists comprehend the nuances:

- We recognize that VA emergency care approval can be unpredictable and often doesn’t match veterans’ expectations

- We know how Medicare Advantage (Part C) plans enhance VA benefits and add additional benefits the VA doesn’t provide

- We grasp VA priority groups and how they affect access to care

- We’ve seen what happens when veterans don’t have proper secondary protection

- We know which Medicare plans work best with existing military benefits

During these consultations, we don’t start with generic Medicare questions. We ask about their VA priority group, how often they use VA care, how far they live from VA facilities, what their backup plan is for emergencies, and whether they travel frequently. These are questions that generic advisors don’t know to ask because they don’t specialize in veteran situations.

4. The Smart Strategy: Layer VA + Medicare for Full Protection

Use VA care where it shines:

- Service-connected conditions or disabilities

- Routine check-ups and preventive care when the VA is convenient

- VA-dispensed prescriptions (often the lowest copays)

- Mental-health services the VA excels at

- Ongoing management of chronic conditions when you trust your VA team

Use Medicare to complete your protection:

- Emergencies when you’re away from a VA hospital

- Specialists the VA can’t provide or can’t provide quickly

- Situations where VA wait lists are too long

- Second opinions from civilian experts

- Care while traveling, snow-birding, or living part-year in another state

- Access to clinical trials or other cutting-edge treatments outside the VA system

Medicare Advantage (Part C): Your Force Multiplier

A Medicare Advantage (Part C) plan is still Medicare, but it layers on valuable extras:

- Nationwide emergency coverage: any hospital, any state. Networks never apply to emergencies

- Specialist access without referrals: most veteran-friendly plans are PPOs, so you can see in or out-of-network doctors with minimal red tape

- MINIMIZING PART B COSTS: Many Medicare options from private companies have premiums as low as $0 per month and help keep your Part B premium as low as possible, keeping more money in your pocket each month

- Additional benefits that VA, Medicare, and TRICARE for Life don’t provide

Bottom line: keep using the VA for what it does best, then let Medicare, especially a carefully chosen Part C plan, plug the remaining while helping you avoid overpaying for Part B.

5. The Independence Factor: Why It Matters

Most Medicare advisors won’t tell you that they’re often tied to specific insurance companies or limited in which plans they can offer. They might have quotas to meet or financial incentives to recommend certain plans.

As independent specialists, we’re not bound by company quotas or pressured to push specific plans. We evaluate ALL available Medicare Advantage plans in your area to find strategies that help you avoid overpaying for Part B based on your specific situation.

This independence allows us to:

- Evaluate all available plans in your area

- Focus solely on your needs, not company quotas

- Provide unbiased recommendations

- Integrate with your existing military benefits properly

Veterans who work with independent specialists consistently get better outcomes because there are no hidden agendas or corporate pressures influencing the recommendations.

6. Common Myths That Cost Veterans Money

I hear dangerous misconceptions regularly, and it’s time to bust them:

Myth: “VA coverage is just as good as Medicare”

Reality: VA coverage is excellent within the VA system but has significant restrictions outside it. Medicare provides universal coverage that VA simply can’t match.

Myth: “Medicare will interfere with my VA benefits”

Reality: Medicare and VA benefits work completely independently. Using Medicare for some services doesn’t affect your VA eligibility for anything.

Myth: “I can’t afford Medicare on top of VA coverage”

Reality: Many Medicare options have premiums as low as $0 while helping keep your Part B premium as low as possible. The real question is whether you can afford NOT to have Medicare.

Myth: “Medicare Advantage (Part C) plans limit my choices”

Reality: The right Medicare Advantage (Part C) plan can actually expand your choices by giving you access to nationwide networks (over 90% of our clients have PPO plans) while keeping all your existing VA benefits.

7. Financial Reality Check: VA-Only vs. Strategic Integration

I want to show you the real numbers over a 10-year period.

VA-Only Strategy (Priority Group 6 veteran)

- Annual travel costs for VA care: $800

- One major non-VA emergency (average every 8 years): $1,250/year

- Out-of-pocket costs for services VA doesn’t cover: $900/year

- Total annual cost: $2,950

- 10-year cost: $29,500

Strategic VA + Medicare Integration

- Medicare Part B premium: $2,220/year ($185/month)

- Medicare options with premiums as low as $0 available

- Strategies to minimize Part B premiums: Potential significant annual savings

- Net Medicare cost: Varies by strategy chosen

- Reduced travel costs (local Medicare providers when needed): Savings potential

- Emergency room coverage nationwide

- Additional benefits that VA doesn’t provide with premiums as low as $0 per month

- Total potential savings: Substantial over 10 years

This doesn’t even account for the peace of mind, convenience, and potentially better health outcomes from having broader access to care.

Note: Opportunities to minimize Part B costs vary by area. In 2025, 32% of Medicare options now include ways to help keep Part B premiums as low as possible (Source: KFF.org, https://www.kff.org/medicare/issue-brief/medicare-advantage-2025-spotlight-a-first-look-at-plan-premiums-and-benefits/).

8. Key Takeaways

✓ VA health care is valuable but has significant parameters outside the VA system

✓ Medicare provides the nationwide safety net that fills critical gaps in VA coverage

✓ Smart veterans use both systems strategically rather than choosing one or the other

✓ Medicare Advantage (Part C) plans can enhance VA benefits without interfering with them

✓ Independent veteran specialists grasp the integration better than generic Medicare advisors

✓ The financial benefits often exceed the costs when you account for travel, emergency coverage, and opportunities to keep Part B premiums as low as possible

These strategic decisions aren’t just about saving money. They’re about ensuring you have the comprehensive coverage you’ve secured by serving our country and your decades of Medicare contributions.

9. What’s Coming Next

Now that you realize how VA benefits and Medicare work together, Chapter 3 explores the unique rules for military retirees with TRICARE for Life.

If you served 20+ years and have military retirement benefits, you’ll learn why Medicare Parts A and B aren’t just recommended. They’re absolutely mandatory to keep your TRICARE for Life benefits. We’ll also explore how the right Medicare Advantage (Part C) plan can actually enhance your military retirement benefits while keeping your Part B premiums as low as possible.

The integration gets even more powerful when you add TRICARE for Life to the mix.

Need help understanding how Medicare works with your specific VA benefits? My team and I help veterans with these decisions every day. Call us at 888-960-8387 (VETS) for personalized guidance that demonstrates what WE SPEAK VETERAN™ really means.

Chapter 3: TRICARE for Life and Medicare

How military retirees keep world-class coverage, and why Parts A & B are absolutely mandatory

1. Do You Qualify for TRICARE for Life?

Let’s start by making sure we’re talking about you. TRICARE for Life (TFL) is arguably one of the best healthcare benefits available to any group of Americans, but not every veteran qualifies. Understanding the requirements is crucial because the rules are non-negotiable.

You’re eligible for TFL if:

- You served 20+ years of active duty (or equivalent Guard/Reserve time)

- You’re enrolled in both Medicare Parts A and B

- You’re a qualified spouse or dependent of an eligible military retiree

The part that trips up many military retirees is this: You must have Medicare Parts A and B. Not just Part A. Not “eventually” Part B. Both parts, active and current. Period.

Some medical retirees with disability ratings also qualify, but the Medicare requirement remains exactly the same for everyone. No exceptions, no special circumstances, no waivers.

Many attempt to skip Part B to save on the monthly premium, but this can be a costly mistake. What they often don’t realize is that doing so also leaves them exposed to lifelong penalties on their Part B premium if they enroll later.

Furthermore, there are many Medicare options with premiums as low as $0 that can help you avoid overpaying for Part B. These options also work with TFL, with TFL providing wraparound coverage for any deductibles, copays, and coinsurance the option doesn’t cover. Choosing to skip Part B means missing out on these valuable benefits you’ve earned.

2. Why Medicare Parts A & B Are Absolutely Non-Negotiable

This isn’t a suggestion from some bureaucrat; it’s federal law written into the statute that created TRICARE for Life. Let me explain why this requirement exists and why you absolutely cannot get around it.

It’s Written in Federal Law

TRICARE for Life was established by Public Law 106-398 (Fiscal Year 2001 National Defense Authorization Act) and is currently governed by 32 CFR § 199.17, which specifically requires both Medicare Parts A and B. The regulation is crystal clear: “when a retiree or retiree family member becomes individually eligible for Medicare Part A and enrolls in Medicare Part B, he/she is automatically eligible for TRICARE-for-Life.” (Source: Law.Cornell.edu, https://www.law.cornell.edu/cfr/text/32/199.17)

The law specifically states that TFL can only function as secondary coverage after Medicare pays first. This means that whether you have Original Medicare or a Medicare Advantage (Part C) plan, your Medicare coverage acts as the primary payer before TFL.

Think of it this way. Medicare is the engine, and TFL is the transmission. You need both for the system to work.

The Financial Architecture

TFL was designed as a “wraparound” benefit that eliminates most out-of-pocket costs after your primary Medicare coverage pays its portion. This means that whether you have Original Medicare or a Medicare Advantage (Part C) plan, the entire financial structure depends on your Medicare coverage being the primary payer:

- Your Medicare coverage pays the majority of your medical bills first

- TRICARE for Life covers what Medicare doesn’t pay

- You end up with virtually zero out-of-pocket costs

Without this Medicare foundation, TFL has nothing to “wrap around” and simply cannot function.

Preventing System Gaming

The Medicare requirement also prevents people from only enrolling when they get sick. If military retirees could choose whether to have Medicare, many healthy retirees might skip it and only enroll when they developed serious health problems. This would drive up costs for everyone and destabilize both systems.

3. How Your Medicare Coverage and TFL Work as a Perfect Team

When you have both your Medicare coverage (whether Original Medicare or a Medicare Advantage plan) and TRICARE for Life active, this is exactly what happens when you receive medical care.

Step 1: Your Medicare Coverage Pays First

Your healthcare provider submits the claim to your Medicare coverage first. Your Medicare plan processes it according to its rules and pays its portion based on Medicare’s approved amount.

Step 2: TRICARE for Life Processes the Remaining Balance

The way TRICARE for Life receives the claim depends on your Medicare choice.

If You Have Original Medicare: Medicare electronically forwards the claim information to Wisconsin Physician Services (WPS), which administers TRICARE for Life. You typically don’t need to file a separate claim or do anything, as this integration happens automatically to cover your deductibles, copays, and coinsurance.

If You Have a Medicare Advantage (Part C) Plan: Your provider will send the claim to your Part C plan, which pays the majority of the cost. Then, it’s common for your provider to send the remaining deductible, copay, or coinsurance portion directly to Wisconsin Physician Services (WPS), which administers TRICARE for Life. WPS then pays the medical provider the amount owed.