Veterans Advantage Financial™

Medicare for Veterans | Fixed Annuities | Retirement Income | Veterans Only

We Speak Veteran™

Lock In Your 5-6% Guaranteed Rate Today

888-960-VETS(8387)

Medicare for Veterans | Fixed Annuities | Retirement Income | Veterans Only

We Speak Veteran™

Lock In Your 5-6% Guaranteed Rate Today

📞 888-960-VETS(8387)Fixed annuity for veterans offers guaranteed growth without market risk. Furthermore, as a veteran, you've earned the right to secure retirement income through MYGA for veterans and veterans guaranteed annuity products. Additionally, Multi-Year Guaranteed Annuities provide fixed annuity rates veterans can count on - 5-6% returns that beat traditional CDs. Moreover, this tax deferred annuity veterans choose most allows your money to grow without annual tax bills.

Veterans seeking a fixed annuity for veterans find MYGAs ideal for retirement planning. However, these products offer more than just predictable returns. In fact, principal protection combined with competitive interest rates makes MYGAs particularly attractive for conservative investors. Subsequently, many veterans discover that MYGAs provide the security they want without sacrificing growth potential.

Veterans guaranteed annuity rates change monthly. Therefore, here are today's top fixed annuity rates veterans can secure:

| Term Length | Current Rate | Minimum Deposit |

|---|---|---|

| 3-Year MYGA | 5.15% | $10,000 |

| 5-Year MYGA | 5.65% | $10,000 |

| 7-Year MYGA | 5.85% | $10,000 |

| 10-Year MYGA | 6.00% | $10,000 |

Rates effective December 2025. Subject to change and state availability.

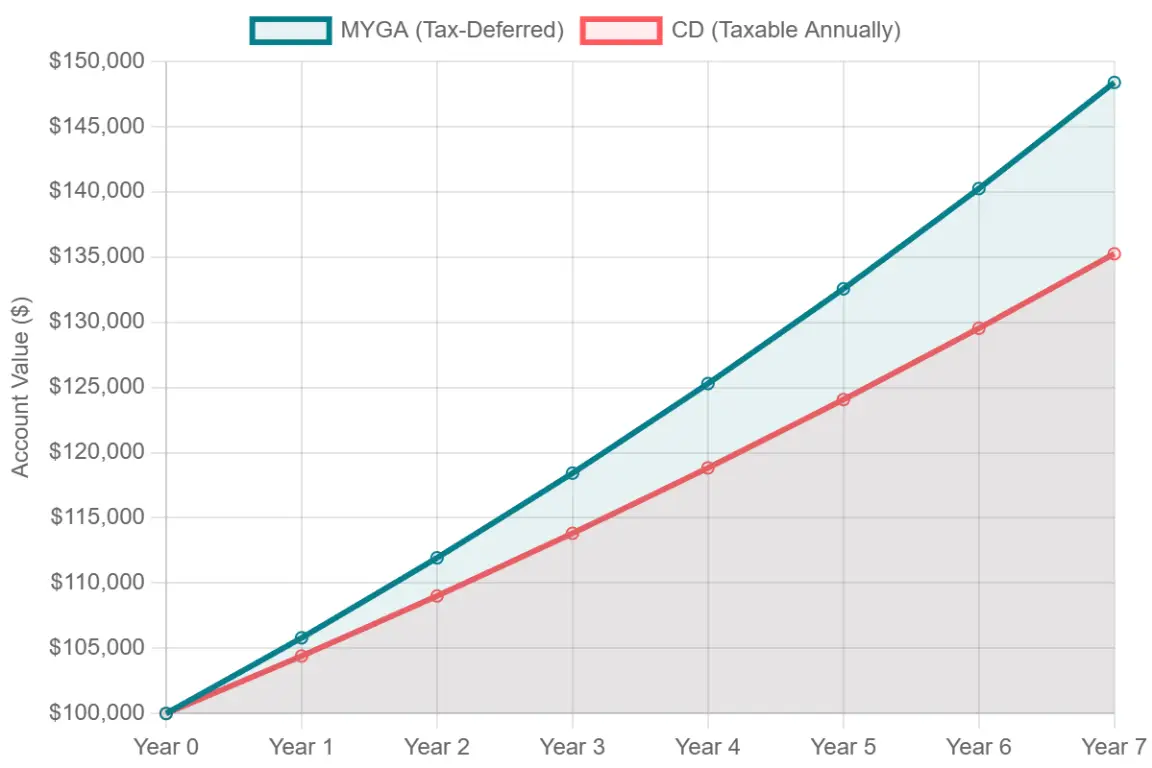

A tax deferred annuity veterans choose most is the MYGA. Unlike CDs, your interest compounds without annual tax bills. As a result, this means more money stays invested and working for you. Furthermore, when comparing a tax deferred annuity veterans select versus taxable investments, the difference in returns can be substantial over time.

Veterans comparing a MYGA for veterans to traditional CDs find clear advantages. First, MYGAs offer higher guaranteed interest rates than most bank products. Second, tax-deferred growth provides significant long-term benefits. Third, state guaranty associations offer protection similar to FDIC coverage. Ultimately, these combined advantages make MYGAs superior for retirement savings.

Your veterans guaranteed annuity works alongside existing benefits seamlessly. Moreover, MYGAs don't affect VA disability compensation or healthcare in any way. Instead, these products simply provide additional retirement security. Consequently, veterans can build wealth while maintaining all their earned benefits. Furthermore, the guaranteed nature of MYGAs means you never have to worry about market downturns affecting your retirement income.

Current fixed annuity rates veterans access through our service exceed most traditional investments. In fact, according to Bankrate's CD rate analysis, MYGAs consistently outperform bank CDs by 0.5-1.5%. Therefore, veterans can achieve better returns while maintaining safety.

Additionally, the Federal Reserve's recent rate decisions impact fixed annuity returns significantly. Therefore, learn more about Federal Reserve interest rate policies affecting retirement savings. Meanwhile, current rates remain attractive for those ready to lock in guaranteed returns.

A fixed annuity for veterans is a Multi-Year Guaranteed Annuity (MYGA) offering guaranteed interest rates. Consequently, veterans use these products for safe, predictable retirement growth. Additionally, the principal protection makes them ideal for conservative investors.

Initially, you deposit a lump sum with an insurance company. Subsequently, they guarantee a fixed interest rate for your chosen term. As a result, your money grows tax-deferred until withdrawal. Furthermore, this predictable growth helps with retirement planning.

Yes, absolutely. Once you lock in your rate, it cannot change during the guarantee period. Furthermore, insurance companies back these guarantees with their reserves and state protection funds. Therefore, you can count on receiving exactly what was promised.

Most MYGAs allow 10% annual withdrawals without penalties. However, full surrender before term-end may incur charges. Additionally, emergency access provisions vary by contract. Nevertheless, the flexibility exists for unexpected needs.

Current MYGA rates of 5-6% typically exceed inflation. Nevertheless, fixed rates provide certainty, though they don't adjust with changing economic conditions. Ultimately, the guaranteed nature provides peace of mind despite market fluctuations.

Ready to secure your annuity for veterans? Therefore, Chris Duncan, RICP®, helps veterans nationwide maximize retirement savings with MYGAs. Moreover, our personalized approach ensures you find the perfect solution for your specific needs. Ultimately, securing guaranteed returns has never been easier.

Important Disclosures:

*Rates shown are illustrative as of December 2025 and subject to change. Actual rates vary by insurer, state, and premium amount. Guarantees are based on the claims-paying ability of the issuing insurance company. Not FDIC/NCUA insured. May lose value if surrendered early. No bank guarantee. Not a deposit. Early withdrawals beyond the penalty-free amount may be subject to surrender charges and market value adjustments. This is a solicitation of insurance. Consult your tax advisor for guidance.

*Retirement Income Certified Professional® and RICP® are registered trademarks of The American College of Financial Services.

Veterans Advantage Financial | Christopher Duncan, RICP® | Licensed in 50 States | Privacy Policy | Terms of Service